Dear the honorable Shareholders:

China Risun Group Limited ("the Company" or "Risun" or "Risun Group") released its financial results for 2023 performance as scheduled. In addition to the Company's annual report, results announcement and ESG report, it has introduced a yearly report on the work of the Company for the year to Shareholders in the form of Letter to Shareholders in recent years. At the same time, it also reports to Shareholders the heart of Risun Group's entrepreneurial, creative and innovative journey, success and failure together with special and common laws and regulations with humble expectation to your guidance and advice.

Compared with 2022, it is even more difficult in 2023. The production volume of Risun has increased significantly, and the revenue has also increased, but the profit has decreased which was mainly due to the sharp decline in selling prices and the increase in costs of raw materials. On a brighter side, the business of refined chemicals, as the second pillar business of Risun Group, has surpassed the business of coke and coking chemicals in terms of revenue and profit in 2023, becoming the second growth curve of Risun Group, which is the witness of Risun's ability and strength to constantly penetrate through cycles.

The economy has cycles, so do the industry and the market, they all have cycles, and the Company also has cycles of survival and development. Any industry is cyclical, fully competitive, relatively surplus in production, and successful enterprises are growing in continuous understanding of various cycles, grasping various cycles, overcoming various cycles and going beyond various cycles. Risun is growing in overcoming and transcending various cycles, and also shaping itself and creating itself in constant understanding and grasping various cycles.

We are pleased to report to you our results in 2023 and the logic of our growth in performance in 2024, our achievements in the five years since listing, and how Risun has grown and grown in the past 29 years through various cycles in this Letter.

Steady development of Risun's business in 2023: coke and refined chemicals' production capacity and output hit new highs; the revenue and profit scale of the refined chemicals segment exceeds that of the coke segment; operation management continued to expand its service territory; the existing industries achieved remarkable results in cost reduction and efficiency enhancement. The new construction and expansion projects are progressing smoothly: Huhhot Production Base with annual output of 3.6 million ton coke and coking chemicals and the hydrogen production comprehensive utilization project have been fully put into operation; Cangzhou Production Base Phase II Project with annual production capacity of 0.3 million ton Caprolactam and Dongming Production Base Project with annual production capacity of 0.3 million ton Caprolactam Capacity Expansion Integration Project have achieved production and efficiency; The project with annual output of 4.8 million ton coke and coking chemicals in Sulawesi Production Base has been put into operation one after another, the comprehensive construction of the international industrial chain and supply chain system has achieved initial results, marking a phased success in the overseas expansion of Risun business.

In 2023, the production volume of the coke segment was 1,210 ten thousand ton, representing an increase of 289 ten thousand ton or 31.38% as compared to 2022; The production volume of the refined chemicals segment was 411 ten thousand ton, representing an increase of 47 ten thousand ton or 12.91% as compared to 2022. By continuously increasing the R&D and innovation, capacity expansion and transformation of existing refined chemicals devices and upstream and downstream supporting facilities, the Company has continuously expanded and extended the industrial chain, and its profitability has been significantly improved. In 2023, as the Company's second pillar business segment and second growth curve, the revenue and profit scale of the refined chemicals segment exceeded that of the coke segment, and its contribution to the Company's performance was more prominent, forming a characteristic industrial chain that is relatively independent, interconnected, supported, supplemented and coordinated with the coke segment.

In 2023, the operation management service segment developed steadily. During the year, Shandong 1.2 million ton/year coke and coking chemicals project, Juye 10 ten thousand ton/year benzene hydrogenation project and Jilin 30 ten thousand ton/year benzene-aniline project were newly added to steadily increase the market share, promote the continuous growth of performance, accelerate the national layout of Risun business, and accelerate the transformation of Risun into a "service-oriented manufacturing industry".

In 2023, all employees of Risun worked together to overcome difficulties and achieved a total business volume of 2,247 ten thousand ton during the Reporting Period, representing an increase of 222 ten thousand ton or 10.96% as compared to 2022; Despite the decline in prices, it still achieved sales revenue of RMB460.66 hundred million, representing an increase of RMB29.27 hundred million or 6.79% as compared to 2022; The Company achieved stable growth in its five-year listing results and continued to enhance its competitiveness.

It was a very difficult and challenging year in 2023. Affected by the overall economic downturn, the net profit attributable to the parent company during the Reporting Period was RMB 8.61 hundred million, representing a decrease of 53.58% as compared with 2022. In response to the cyclical changes in the industry, the Company formulated the overall strategy of "controlling investment, reducing costs and increasing benefits" at the beginning of 2022. By strictly controlling investment, reducing five types of expenses and two types of costs, improving per capita labour efficiency through automation and informatization, and developing revenue growth channels through product innovation and market prediction, the Company reduced costs and expenses by RMB4 hundred million and increased revenue and profit by RMB6 hundred million throughout the year.

Looking back on the development history of Risun, the Company has developed together with refined chemicals through coke, forming two major pillar business segments. Through the two growth curves, coordinating the domestic and international markets, and balancing the self-construction and operation management services, the Company has forged its core competitiveness, laying a good foundation for fully completing the 2024 performance target and going through the current cycle.

Table 1: China Risun Group Business operating data for the past two years Unit: Million ton, RMB hundred million

|

Note: Total business volume includes coke, refined chemicals, operation management and hydrogen energy business segments.

(1) Risun business volume 2,247 ten thousand ton in 2023, representing an increase of 222 ten thousand ton as compared to 2022, among which, the coke segment increased by 289 ten thousand ton, the refined chemicals segment increased by 47 ten thousand ton, the hydrogen energy segment increased by 536 ten thousand standard cubic metres, and the operation management segment decreased by 114 ten thousand ton.

(2) Net profit attributable to owners of the parent in 2023 amounted to RMB8.61 hundred million, representing a decrease of RMB9.94 hundred million or 53.58% as compared with 2022. Net profit attributable to owners of the parent of coke segment amounted to RMB3.69 hundred million, net profit attributable to owners of the parent of refined chemicals segment amounted to RMB 6.79 hundred million, net profit attributable to owners of the parent of operation management segment amounted to negative RMB1.94 hundred million, and net profit attributable to owners of the parent of hydrogen energy segment amounted to RMB0.07 hundred million.

(3) The decrease in profit in 2023 was mainly due to the narrowing of coke price spread and the decrease in gross profit of operation management service business, the price of coke decreased by RMB840.3/ton as compared with 2022, the price of coal decreased by RMB370/ton, and the price of coal coke price spread narrowed by RMB203/ton; The gross profit margin of coke and coal price fluctuation of operation management segment was 3.48%, representing a decrease of 2.93% as compared with 2022.

(4)refined chemicals segment recorded a net profit of RMB6.79 hundred million, representing an increase of RMB2.36 hundred million as compared to 2022, mainly benefiting from the significant reduction in single ton cost of Cangzhou and Dongming Caprolactam product lines and the profit release of new production capacity.

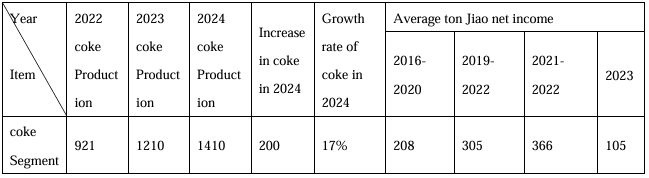

Table 2: Operating data of China Risun Group coke segment for the past two years: Unit: Million ton, RMB hundred million |

Note: Production volume (operation) includes the production volume of coke, a wholly-owned and joint venture company, excluding operation management service projects. |

(1) The production volume of coke in 2023 was 1,210 ten thousand ton, representing an increase of 289 ten thousand ton as compared with 2022, mainly due to the increase of 223 ten thousand ton in the production volume of Risun China Gas Phase II, the increase of 33 ten thousand ton in the production volume of Risun Wei Shan projects, and the increase of 33 ten thousand ton in the original production capacity.

(2) Changes in revenue and profit indicators:

① Revenue Growth: In 2023, the revenue of the coke segment was RMB181 hundred million, representing an increase of RMB17 hundred million as compared to 2022, mainly due to two factors: first, the revenue decreased by RMB77 hundred million due to the impact of price reduction; second, the revenue increased by RMB94 hundred million due to the impact of business increment; and the total net increase of revenue was RMB17 hundred million.

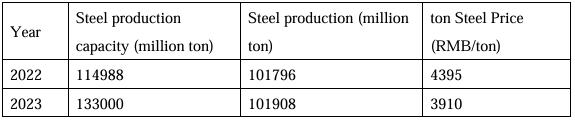

②: The decrease in profit of coke in 2023 was mainly due to the impact of the decrease in price spread. The ex-factory price of coke was RMB2,537 per ton, representing a decrease of RMB694 or 21% as compared to 2022; The average blending price was RMB1,694 per ton, representing a decrease of RMB370 or 18% as compared with 2022; The coal coke price spread narrowed by RMB203 per ton, representing a decrease of 35% as compared with 2022.

③: Risun coke Owned, Associate and Joint Venture, operation management Served business volume and trade volume of 1,583 ten thousand ton, accounting for 5.08% of China's independent coke corporate metallurgical coke commodity 3.08 hundred million ton, representing an increase of 0.27% over 2022.

(3) coke industry has narrowed the price spread for two consecutive years since 2022, and the elimination of the industry has accelerated. As a leading enterprise in the industry, Risun consolidates its core competitiveness and seizes market opportunities through the following measures, laying the foundation for subsequent operation management services and mergers and acquisitions:

Firstly, the Company will increase investment in research and development and innovation, enhance customer stickiness by developing customized coke varieties, and continue to develop new coal varieties relying on its own blending research capabilities, so as to reduce the cost of blending and further improve profitability;

Secondly, we will reduce various production costs through internal potential tapping, increase the automation and informatization transformation of production devices, optimize organizational and process construction, improve per capita output and per capita labour efficiency, and consolidate low-cost advantages;

Third, establish a global supply chain system and marketing network to achieve business synergy between domestic and international markets;

Fourthly, the Company will continue to increase the mergers and acquisitions of coke and operation management services, and realize the operation scale of coke exceeding 3,000 ten thousand ton per year, so as to promote the transformation of manufacturing industry to a service-oriented manufacturing industry.

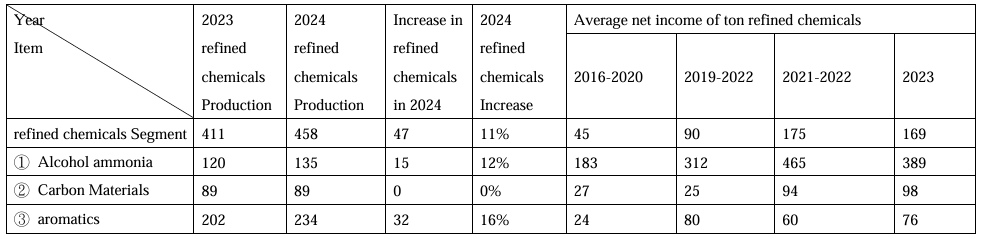

Table 3: China Risun Group refined chemicals Business operating data for the past two years Unit: Million ton, RMB hundred million |

|

In 2023, the production volume of Risun refined chemicals segment was 411 ten thousand ton, representing an increase of 47 ten thousand ton or 12.91% as compared to 2022; the revenue was RMB186 hundred million, representing an increase of RMB32 hundred million or 20.78% as compared to 2022; the net profit was RMB6.79 hundred million, representing an increase of RMB2.36 hundred million or 53.27% as compared to 2022.

In 2023, the revenue and profit of the Risun refined chemicals segment exceeded that of the coke segment for the first time. Over the years, the Group has continued to increase the technological transformation, research and development and capacity expansion and transformation of refined chemicals device, and the production cost has been significantly reduced. The Company attaches great importance to technological innovation, and relies on technological progress to reduce costs and increase efficiency. The production cost of ton, a benzene hydrogenation facility of Tangshan Risun, has decreased by RMB200, and the production cost of Risun Caprolactam ton in Cangzhou has decreased by RMB1,800.

The Group's refined chemicals production capacity and market share have steadily increased. As of the end of 2023, Risun has become: World's largest coking crude benzene processor, World's second high temperature coal tar largest processor, the world's second largest Caprolactam producer , China's largest Industrial-naphthalene-based phthalic anhydride producer, and China's largest coke oven coal-to-gas methanol and synthetic ammonia producer .

In 2005, when the 10th anniversary of the founding of Risun, the production scale of Risun's coke has become the first in China. After conducting multi-industry comparisons, Risun decided to enter the refined chemicals industry. In April 2007, the first set of refined chemicals facilities was completed, and the Company continued to expand into the refined chemicals industry in accordance with the vertical integration development model. The Company has achieved a transformation from coke to coke. After nearly 20 years of continuous development, the refined chemicals segment has gradually expanded from coal refined chemicals to oil refined chemicals, and gradually expanded into the Group's second pillar business segment, providing a solid industrial guarantee for the Company to fight against cyclical fluctuations.

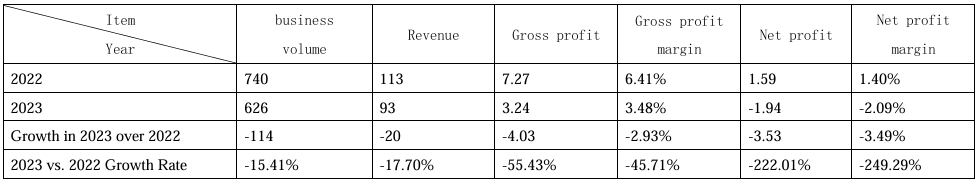

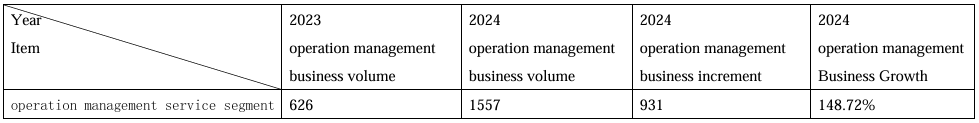

Table 4: Operating data of China Risun Group operation management service business in the past two years

Unit: Million ton, RMB billion

Note: operation management Service business volume includes operation management Service business volume + Service Trade business volume.

The Risun operation management business recorded a loss in 2023, mainly due to the following reasons: due to the expiration of the contracts of the operation management projects in Jiangxi and Henan, the business volume and profit were reduced; Shandong Juye Project has just been taken over, the supply chain has not been rationalized, and the production cost is too high; Due to the decline in prices, there was a loss in the unilateral trade, and the production volume was also declining. These three scenarios combined affected the profit in 2023. The latter two scenarios are improving in the fourth quarter of 2023, and the Group is expanding the scope of operation management projects and believes that there will be significant improvements in 2024.

In 2014, Risun started the service output of operation management project, which includes production services, technical services, environmental protection services, management services, marketing services, etc. The Company has refined, integrated, solidified and replicated its years of industry-leading experience in coke and refined chemicals operation management, and provided operation management and technology export services to third-party coke and refined chemicals companies to enhance market share and empower the industry, which has become an important way for the Company's strategic expansion and development.

In 2023, Risun successfully developed the Shandong coke and benzene hydrogenation projects, and the Jilin Styrolactam project, expanding the scale of operation management. At the same time, the Company carried out management reform on the trade supply chain business, transforming the trade supply chain business into a business model of marketing integration, contract processing, leasing, custody, etc., changing the traditional unilateral trading of simple goods to service-oriented trading, and adopting the operation management service model to provide customers with comprehensive services. The Company has always been customer-oriented, order-driven, relying on stable quality management, logistics management, product customization services and information services, etc., to solve various problems such as supply chain, production and operation and technology for customers, and promote the transformation of the Company to a service-oriented manufacturing industry.

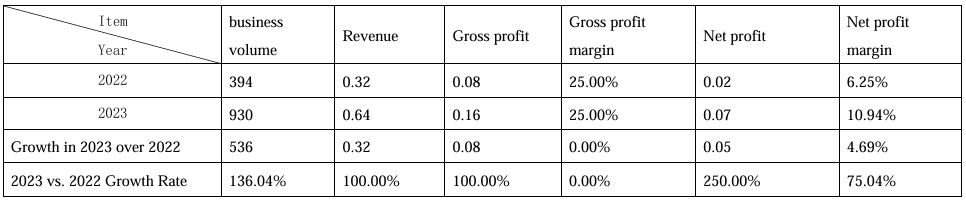

Table 5: China Risun Group hydrogen energy Business operating data for the past two years Unit: million standard cubic metres, RMB hundred million |

In 2023, the hydrogen business volume was 930 ten thousand standard cubic metres, representing an increase of 536 ten thousand standard cubic metres or 135.76% as compared to 2022. Hydrogen supply in Beijing continued, with a monthly supply of 20 ten thousand standard cubic metres. The revenue scale of hydrogen energy business reached RMB0.55 hundred million, representing an increase of 73.06% over 2022.

In 2023, Risun hydrogen energy promoted the national layout and built a full ecological industrial chain of "production, storage, transportation, processing, use and research".

(1) In terms of hydrogen production, in 2023, Risun Group's high-purity hydrogen production accounted for approximately 2.3% of the market share in China, ranking fifth in China and first in the Beijing-Tianjin-Hebei region. While ensuring the quality of hydrogen, it has become one of the first enterprises in China to officially obtain the clean hydrogen certification of demonstration city clusters, which has enhanced the brand influence and industry competitiveness of Risun hydrogen energy. The greenhouse gas emission value per kilogram of hydrogen in the whole process is less than 4.90kg, and the total production capacity of high-purity hydrogen can achieve a carbon reduction of 5.8 ten thousand ton per year.

(2) In terms of the construction of hydrogen storage and transportation capacity, the Group continued to expand the scale of transportation fleet, with a year-on-year increase of 110% in hydrogen transportation guarantee capacity, and the hydrogen delivery business spread across the Beijing-Tianjin-Hebei region.

(3) In terms of the operation of hydrogen refueling stations, three hydrogen refueling stations have been built in Dingzhou, Xingtai and Baoding with a total of hydrogen energy capacity of 3 ton/day. The comprehensive energy station in Dingzhou operated at full capacity and achieved hydrogen refueling of 220 ten thousand standard cubic metres for the year, achieving stable profits.

(4) In terms of the application scenarios of hydrogen energy, a number of hydrogen energy heavy truck transportation lines have been established, such as Dingzhou to Xinji, Dingzhou to Tianjin, and Baoding easy line, to replace traditional fuel truck transportation products such as coke and coal with hydrogen energy heavy trucks, with a shipping capacity of nearly 5000 ton per day. In 2023, more than 60 hydrogen fuel cell vehicles were added to help Production Base complete green transportation indicators. At the same time, the application of hydrogen energy heavy trucks such as short fall, loading and dump trucks within Production Base is also gradually expanding.

(5) In terms of R & D and innovation, the Company built a scientific research platform system, completed the construction of the hydrogen energy laboratory, equipped with more than 20 core equipment such as electrochemical workstations and vacuum tube electric furnaces, and carried out the R&D of key materials such as precipitation hydrogen catalysts and liquid hydrogen catalysts. We participated in the compilation of the group standard "coke oven High-purity Hydrogen to refined chemicals Technical Safety Technical Requirements" and the local standard of Hebei "Regulations on the Operation and Management of Hydrogen Refueling Stations".

(6) In 2023, Xuyang will achieve a carbon reduction of 9,700 tons due to the use of hydrogen energy, with an average of 11.68 kg per kilogram of hydrogen.

After three years of development since 2020, the Company has completed and put into operation four production lines of 24 ton/day high-purity hydrogen, becoming the fifth largest high-purity hydrogen producer and supplier in Beijing-Tianjin-Hebei region in China; 3 hydrogen refueling stations have been completed and put into operation, becoming the enterprise with the largest number of wholly-owned stations in Hebei Province; The Company has formed a stable profit model for the whole industry chain from production to storage, transportation to processing and utilization, and built an effective, effective and responsive Risun hydrogen energy ecology.

Table 6: China Risun Group Business Financial Indicators for the past two years Unit: Million ton, RMB hundred million |

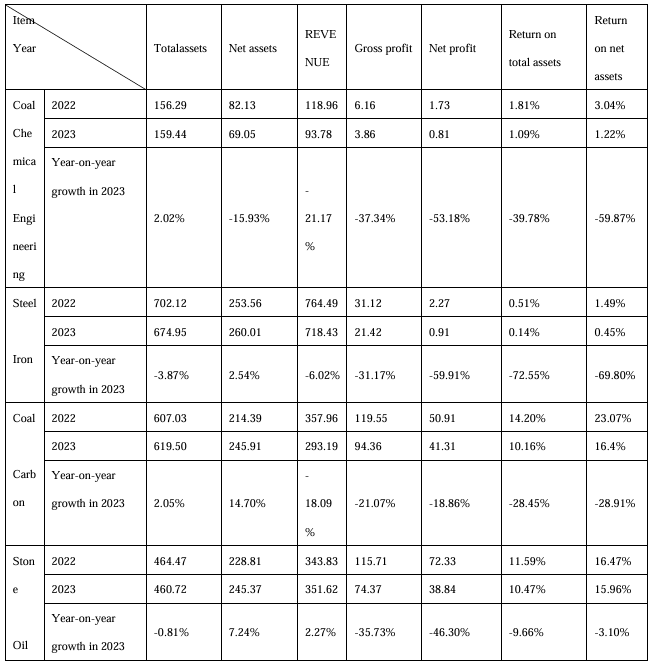

Table 7: Financial indicators of CITIC Coal refined chemicals, coal, oil and steel industries in the past two years

Unit: RMB hundred million

Note: 1. CITIC Industry: referring to the industry classification in the version 2.0 of CITIC Securities Industry Classification Standards and the revision notes.

2. The data in the table are from the database of Wind, a total of 10 listed companies are included in the CITIC Coal refined chemicals industry, 6 listed companies are included in the CITIC Petroleum industry, 20 listed companies are included in the CITIC Coal Industry, and 19 listed companies are included in the CITIC Steel Industry. The data in the table are derived from the median of listed companies in various industries.

The growth rate of Risun's total assets, net assets and revenue in 2023 is higher than the industry financial indicators of CITIC Coal refined chemicals; Although the net profit decreased compared with 2022, the decrease was far lower than that of the same industry; Return on total assets and net assets outperformed the industry. The Company's development capability, profitability and operating capability are higher than the industry indicators. The Company will continue to rely on its scale advantage, operation management advantage and industry integration ability to promote the sustainable development of Risun.

In 2023, macro factors such as competition from major international countries, regional conflicts, reshaping of global supply chain, and economic momentum transformation changed. The domestic real estate industry declined, investment and consumer demand in the macro environment was insufficient, prices of various products declined, and price spread narrowed, and the strength of Risun was improved:

The refined chemicals segment, as the second Risun second pillar business segment, extends the chain to strengthen the chain, forms the second performance growth curve, and is highly synergistic with the coke segment, making the Company's development more stable and resilient.

The Risun Wei Shan project has been successively completed and put into operation. On the basis of the establishment of overseas offices and subsidiaries in Australia, Japan, Vietnam, Singapore, etc., an Indian office has been added, initially forming a global customer network, forming a global sales chain and supply chain, and the Risun business has achieved initial success in global development, laying a solid foundation for the internationalization strategy of Risun.

The production capacity and output of coke and coking chemicals and refined chemicals industries continued to grow, continuously consolidating the leading position of Risun in the industry. coke segment insisted on growing bigger and stronger, and the position of World’s largest independent coke producer and supplier was increasingly solidified. The production capacity of Caprolactam reached 75 ten thousand ton/year, becoming the world’s second largest Caprolactam producer and supplier.

The service area of Risun operation management continues to expand, with the addition of coke 120 ten thousand ton and refined chemicals 40 ten thousand ton in 2023. The transformation of Risun from "manufacturing" to "service-oriented manufacturing" has accelerated.

Risun firmly implemented the policy of "controlling investment, reducing costs and increasing benefits", and achieved remarkable results. It slowed down capital expenditures, reduced costs and expenses by RMB4 hundred million, and increased revenue and profit by RMB6 hundred million, which effectively hedged against the fluctuations of the downward cycle of the industry.

In 2023, the price of coke is declining, and the price spread in the coke and coking chemicals industry is narrowing. However, the overall profitability of the refined chemicals industry is increasing, and will continue to increase in 2024. Risun’s ability to control costs is superior, especially the integrated operation of sales, transportation, production, supply and research. Not only can it be customized production and order-driven scale expansion, but it can also increase the gross profit per unit product, improve the asset turnover speed, and systematically reduce various costs. Despite the decline in the overall profit of the Group in 2023, the scale of the Group is growing rapidly, the profitability of the refined chemicals industry is improving significantly, and the comprehensive strength is continuously strengthening. All these have laid the foundation for future development.

Over the past five years since Risun was listed, the capital market has experienced ups and downs caused by various changes in the macroeconomic environment at home and abroad. In the capital market and industry upward cycle, the Company has achieved relatively high profits, and its market value has repeatedly hit new highs, bringing high returns to investors; In the downward cycle of the capital market and the industry, the Company has relied on its core competitiveness for twenty-nine years to make steady progress and go through the cycle, which not only highlights the advantages of the industry leader, but also shows that the market value has outperformed the market.

The capital market has experienced significant volatility over the past five years, and even in such an external environment, Risun has achieved excellent performance. Over the past five years since its listing, the Company has been recognised by investors based on its industry advantages. Regardless of the changes in the external environment of the capital market, the development prospects and long-term investment value of the Company remain unchanged.

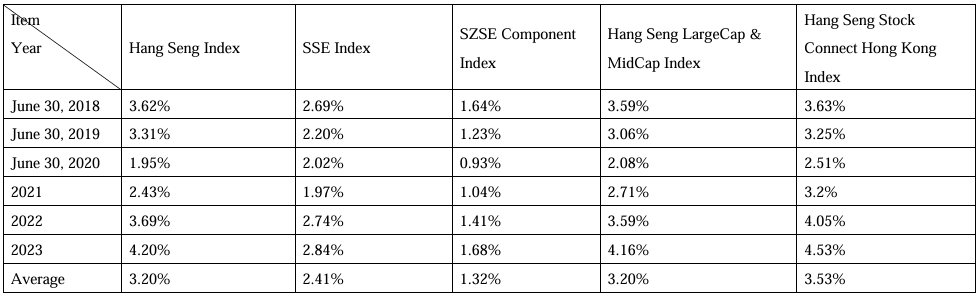

Table 8: Performance of China Risun Group and capital market key indices Unit: HK$/share Note: 1. China Risun Group has been included in the Hang Seng LargeCap & MidCap Index and the Hang Seng Stock Connect Hong Kong Index; 2. The annualised return rate of China Risun Group is calculated based on the post-reset right.

|

(1) Steady increase in market value of share price

Since 2019, major indexes in China have all experienced declines to varying degrees, of which the decline of the Hong Kong Hang Seng Index has been obvious. Under such circumstances, the share price of Risun still achieved stable growth as compared to the beginning of its listing (March 15, 2019), with a 5-year share price increase of 12.5% on a non-recurring basis; The share price increased by 45.16% in five years based on the post-recycling right, and the annualized return rate was 7.66% (the closing price of the shares on April 330, 2024 compared with the issue price of the shares on March 15, 2019 of HK$2.8), which brought investment income to the investors. With the steady growth of the share price, the Company’s market capitalization has also steadily increased. Based on the non-repeated calculation, the current market capitalization is HK$13,936,000,000, representing an increase of 24.43% as compared with HK$11,200,000,000 at the beginning of the listing.

(2) Continuous optimization of shareholder structure

Risun actively carried out shareholder optimization, continued to conduct public roadshows in five years, and has conducted 788 roadshows to domestic and foreign institutions, with more than 1200 participants. Domestic and foreign investors and analysts have responded positively, and have given China Risun a “Buy” or “Increase” rating. The Company entered the Hong Kong Stock Connect in 2019, and the shareholding of the Hong Kong Stock Connect continued to increase in the past five years, from 3,965,000 shares as at December 31, 2019 to 337,000,000 shares (as at April 30, 2024), representing an increase of nearly 85 times, accounting for 26.81% of the outstanding share capital and 7.65% of the total number of Hong Kong shares. In 2021, the Company raised HK$2,065,000,000 through initial public offering. Through the continuous introduction of strategic and financial investors, the Company’s shareholding structure has been continuously optimized, with public shares accounting for 28.63% of the total share capital, representing an increase of 20.24% from the beginning of the listing. In the future, we hope that investors will continue to support the development of the Company, and the Company will continue to return to investors as much as we can.

(3) Recognized Investment Value

Over the past five years, Risun has been included in 20 indices of the Hang Seng Family Index and 3 indices of the FTSE Global Equity Index through its outstanding capital market performance. With the gradual recognition of the Company in the capital market, the trading volume of the Company's shares has achieved steady growth. Currently, the average daily trading volume has remained stable at more than 3,000,000 shares. At the same time, investors' attention is also increasing, and the Company's share price has achieved continuous and stable growth. In November 2023, the Company was included in the China Index of the MSCI Global Small Cap Index and the MSCI China All Shares Small Cap Index in the MSCI Index Series established by MSCI. The investable value of the Company was not only recognized by domestic investors, but also gradually emerged in the global capital market.

(4) Increase in shareholding and repurchase to demonstrate confidence

The major shareholders, directors and management of Risun have always believed that the Company has long-term investment value. The major shareholders, directors and management of the Company have continued to repurchase and increase their shareholdings in the Company in five years after the listing. As of April 30, 2024, the Company has repurchased a total of 34,314,000 shares, and the major shareholders have increased their shareholdings by 50,645,000 shares. Even in the face of fluctuations in the capital market, the Company’s major shareholders, directors and management still firmly believe that the stock price and market value correction are temporary, and are willing to share risks with investors, demonstrating their firm confidence in the Company's future development.

Risun hopes to share the Company’s achievements with investors at the beginning of its listing. The Company believes that coke, as the first pillar business segment, will continue to protect the Company’s core value in the future, and the refined chemicals industry, as the second pillar business segment, will bring the Company a second growth curve and create the ability to go through the cycle. The Company will also continue to cultivate new business segments such as hydrogen energy and new materials, and strive to create pillar business segment for future development. At the same time, the Company is accelerating the transformation to a service-oriented manufacturing industry, developing towards an international company, creating a global industrial chain and supply chain, further enhancing the Company’s value in the capital market, and bringing sustainable and stable returns to investors.

Table 9: Dividend Distribution of China Risun Group for 2018-2023 Unit: HK$ |

Note: The dividend rate is calculated based on the issue price of HK$2.8 per share on the listing date.

Table 10: Dividend yield of major indexes in China’s capital market

Notes: 1. Data from wind database.

Risun has been committed to paying dividends of no less than 30% of net profit to all investors in five years since its listing. Since 2020, the dividend ratio of the Company has been continuously higher than 31%. In the past five years, the Company has distributed 11 dividends to investors, with a total amount of HK$3,740,000,000 and an average dividend yield of 5.24%. Compared with the average dividend yield of major domestic indices in the past five years, the Company has achieved a higher dividend yield of 69.32% than the Hang Seng Index, 124.83% higher than the SSE Composite Index, and 310.48% higher than the SZSE Component Index. The investors have also achieved solid returns in long-term cooperation with the Company.

With the revenue and profit of Risun's refined chemicals business segment surpassing the coke business segment in the first half of 2023, the Company has demonstrated its ability to go through the cycle through strategic adjustments in every five-year plan. The Company has always believed that with the gradual enrichment of the industrial chain and product lines, it is also expected to build a community of interests, undertakings and destiny with investors in the future, so as to bring long-term and considerable benefits to investors with the stable development and steady growth of the Company.

The entrepreneurial process of Risun is the process of controlling risks. In the process of creating wealth and perfect life, the Company's strength is strengthening, the wealth is increasing, how to control risks, and develop in risks have become an important factor for the sustainable development of the Company. The Company studied failed cases such as delisting, bankruptcy and significant decline in market value among 2610 Hong Kong listed companies and 5363 A-share listed companies, and found that there were risks such as legal compliance, major shareholder risks, investment management, operation management and financing loans. The Company conducted detailed analysis on the above risks and formulated corresponding management systems.

(1) Risk control of Risun

From 1995 to 2002, after seven years of hard work, Risun survived. After 2002, the Company continued to grow stronger and bigger, and in the process of gradual exploration and development, three control measures were formulated for possible risks. The first is comprehensive and legal compliance, the second is the whole process control of project investment, and the third is the full closed-loop control of business decision-making.

Firstly, Risun is in essence fully compliant and legal in the process of development, which involves financial compliance, as well as legal compliance in safety, environmental protection and other aspects. In accordance with national laws and local government regulations, the Company's strategies and development goals are consistent with the government's goals and policies, and the risks are controlled at the bottom level.

Secondly, Risun managed and controlled all the risks that may occur in project investment in a targeted manner, and made sufficient preparations before project decision-making, and continued to study and track potential risks after project implementation. The Company is well aware that there is no risk-free project investment in the world. For investment risks, the Company has formulated plans in advance and prevented them in advance, and has clear plan measures, system processes and teams to prevent and defuse risks.

Third, in terms of operation and management, Risun is logical in terms of strategy and strategy, as well as methods and goals, which are put forward based on long-term understanding and summary of laws. The Company proposes the annual operating budget, five-year plan and ten-year outline, which is to make the operation and management clearer, clearer and more open, and get tested by history and everyone.

In 2019, Risun was listed in Hong Kong. In order to prevent the risks of listed companies, the Company added three new measures based on the risk control measures of general companies. The first is the legal and compliance control of the listed company, the second is the equity and stock risk control of the listed company, and the third is the cash flow risk control.

The legal compliance of Risun before its listing is based on the legal compliance of general companies. After its listing, the Company shall also comply with the rules for listed companies and the rules and regulations of the Hong Kong Stock Exchange. The legal compliance of listed companies is stricter, more specific and more open than non-listed companies. All behaviours of the Company are open and subject to all-round supervision and management, so that the Company can be more long-term and secure, and sustainable and healthy development.

Risun is well aware that the capital market can obtain low-cost funds during the development of the Company, but it will also have an impact on the Company. Therefore, the Company has formulated the principle of zero pledge and no pledge of shares at the beginning of its listing, and at the same time, with strong cash flow, the Company can still avoid the risk of the Company's share price even when the Hang Seng Index has dropped significantly in the past five years.

Risun always adheres to the principle of cash flow first and always places operating cash flow first in operation and management. Strictly control capital expenditures and keep capital expenditures under control. Strictly abide by the debt agreement, always keep the debt within a certain range, and ensure that all debts are normal with sufficient cash flow. Risun has not experienced one debt default since its inception.

(2) Targeted prevention and control

Risun believes that risk is a recurring problem, rather than a short-term problem, and long-term development will have frequent risk exposures, but sometimes stronger and sometimes weaker. The Company has always reminded the management team to avoid risk losses as much as possible, so as to achieve prevention in advance and control in the process, and never occurrence of major risks. To this end, the Company has formulated targeted strategies and systems.

① Risk Management

Risun has built an external and internal risk control system. External risk control includes the work of laws, regulations and policies involved in the survival and development of the Company; In terms of internal risk control, the Company has established the Risk Control Committee to continuously improve internal and external risk control, including internal major project investment, major economic contracts and major decision-making matters.

② Improving governance system

Risun continued to improve the corporate governance system, promoted the continuous improvement of management level, and ensured the transparency of the rights and responsibilities of corporate management. Nine committees were set up, including the Investment Committee, the Price Committee, the Related Party Transaction Committee, the Risk Management and Control Committee, the Finance Committee, the Safety, Health and Environmental Protection Committee and the Supervision and Audit Committee, which put forward strict requirements for corporate governance and management systems to prevent corporate governance risks.

③ Strengthening Board Functions

While adhering to high-quality development, Risun continuously improved its ability to cope with risks. The Company continued to strengthen the functions of Directors, with three independent non-executive Directors out of nine Directors. In 2024, the Company appointed female directors for the first time, marking an important step forward in the governance of gender equality and diversity on the Board of the Company. At present, the Directors of the Company have different knowledge and skills, mutual coordination and overall combat. They have considerable experience and capabilities in strategic planning, corporate governance and operation management for the survival and development of Risun, which effectively ensures the long-term stability and sustainable development of the Company.

④ Environmental, Social and Governance

The board of directors and the management of Risun attach great importance to the environmental, social and governance strategy, regularly listen to reports and inspections, conduct information disclosure, and consider a number of issues such as safety, environment and employees, so as to provide unified guidance, make decisions and promote the implementation of environmental, social and governance goals, eliminate all risks in relevant aspects, and improve the Company's transparency and the linkage with the capital market.

Risun's long-term survival and development is an extremely difficult process, and the process of understanding, preventing and controlling risks. Over the past twenty-nine years, the Company has embarked on a steady and sustainable development path, a development path through the cycle, and a path of healthy and sustainable growth at all times and under all circumstances.

Before the launch of the listing, Risun proposed the goal of striving to be an excellent listed company. The Company believes that an excellent listed company is a company with stable profit growth year by year, excellent performance in the capital market, continuous return to investors, control various risks, achieve long-term healthy development, and contribute to social progress.

(1) Steady growth in performance and prominent position in the industry

Table 11: 2019-2023 China Risun Group Performance Metrics Unit: RMB ten thousand/person/day | |

Note: In 2020, 2021, 2022 and 2023, the total number of employees of the Company and its subsidiaries was 4407, 7678, 7473 and 7601, respectively. In addition, the number of reserve talents is 449, 526, 520 and 631, respectively.

| |

Table 12: 2019-2023 CITIC Category coke and Coal refined chemicals Industry Performance Metrics Unit: RMB ten thousand/person/day | |

Note: The data in the table comes from Wind database. There are 10 listed enterprises in CITIC Coal chemical industry. The value of the data in the table comes from the median of the listed enterprises. |

Risun has achieved stable performance growth in five years since its listing. In 2023, the Company was once again selected as one of the Fortune 500 Chinese Listed Companies, ranking 271, up 51 places from 2022. Through the gradual expansion of revenue and operation scale, the gradual increase in R & D and reserve technical personnel, the stable increase in R & D and innovation investment costs, the R & D conversion rate has been rapidly improved, and the Company has demonstrated its ability to go through the cycle in the downward cycle of the industry.

In 2023, the industry as a whole experienced a significant downturn, and the profitability of Risun far exceeded the industry average, but there were also some shortcomings. In the course of twenty-nine years of development, although the Company has gained the ability to cross the cycle and continue to grow, it still lacks the ability to counter the cycle development. Companies with counter-cyclical development capabilities can achieve continuous, stable and rapid growth in any period and under any circumstances. The refined chemicals industry, the second pillar of the Company, has become an important segment of counter-cyclical growth, and the business segments such as hydrogen energy and new materials are gradually expanding. In the future, it will play a role as an important segment of counter-cyclical growth to achieve stable and long-term growth of the Company.

(2) Stable investment returns and excellent market performance

The market value and share price of Risun have increased steadily in the past five years against the trend, and the Company has fulfilled its promise of annual dividend of not less than 30% of net profit, and investors have also received due returns. Although the annual return on investment of the Company's shares reaches 7.66%, such return still lags behind the Company's expectations.

In the past five years, the domestic capital market fluctuated sharply and the Hong Kong stock market fell sharply. As a result, the Company faced problems such as narrowing the increase in share price and unstable trading volume under the condition of stable performance. Based on its historical experience, the Company has increased the scale of domestic and foreign roadshows, strived to include more international indices, enhanced the popularity of the capital market, and introduced more international investors. The Company believes that with the stabilization of the domestic and international economic environment, the return of the capital market to the normal share price and market value of the Company will usher in a new upward stage, and bring more abundant returns to investors.

(3) Sound management and control system and comprehensive risk prevention

Relying on twenty-nine years of development experience, Risun has formed a risk management system covering investment, operation, management and other aspects to ensure risk prevention and achieve all-round full-cycle risk control. The Company has not experienced any systemic risk crisis in the past five years since its listing.

In the past two years, the Company's investment scale has expanded, and the debt ratio has increased. In order to prevent debt risks, the Company took precautions and control in advance, clarified the control system of debt ratio, clarified the control target of total debt ratio, clarified the risk control measures of each liability, clarified the bottom line and red line of debt control, set the annual total investment cap, and set five capital control rules including safety reserve funds to ensure that the Company does not have any risks and sustainable development under any circumstances.

(4) Demonstrate corporate responsibility and actively contribute to the society

In the process of entrepreneurship, creation and innovation, Risun has established the highest safety, environmental protection and quality standards in the industry. While providing value for upstream and downstream, it also provides services for the industry and empowers the industry. We will join hands with our employees to start business, progress and grow together, and form a community of interests, a community of undertakings and a community of destiny with our employees. We actively contributed to the society, participated in various public welfare activities, and provided assistance within our capacity. We carry out school-enterprise cooperation, promote R&D innovation, go deep into enterprises and colleges, form good co-construction partners with communities, develop together, and strive to fulfil the obligations of excellent corporate citizens.

Risun has a long vision and mission, a simple and concise development approach, an open and transparent operation and management model, a clear direction, a correct path, a long-term strategy, and a flexible strategy. We will not take a small path, do business hard, do not take advantage of opportunities, comply with laws and regulations, abide by principles and rules, stick to industry, adapt to trends, and conform to laws. We believe that the world, China, the future, and ourselves. At all times, we will not be complacent, suspect, hesitant, dare, dare, fearless, maintain the ordinary attitude of long-term struggle, maintain the confidence of fighting to the end, and move forward with determination to build Risun into a world-leading energy refined chemicals company.

Any industry is cyclical, any industry is surplus, and any industry is fully competitive; There is no industry with no cycle, no scarce industry, or no industry with no competition; Any company is also cyclical, not dead in the cycle, that is, long in the cycle.

Risun currently owns two pillar business segment, namely coke and refined chemicals. Among them, the coke industry is the first industrial carrier founded by Risun, witnessing the growth and expansion of the Company. Based on the business data of Risun coke, and with reference to the industry data of the two major industries of upstream coal and downstream steel, we analysed and studied the changes and characteristics of the industry in different periods based on the industry operation data of more than 30 years, and initially developed three large-cycle changes, so as to review and summarise how Risun has done, what has done, and what has failed lessons in different cycles, which have increased the ability, and formed the core competitiveness which can be replicated, inherited and carried forward, and how Risun has grown further while navigating the cycle.

The three cycles are 1990-1999, 2000-2009 and 2010-2021, respectively. The industry entered the fourth cycle after 2022. Risun’s refined chemicals industry is also cyclical. Although different refined chemicals products have different cycles, they are mostly in the same industry as the petrochemical industry cycle and are also cyclical.

Not all entrepreneurs can go through different cycles, and most entrepreneurs will disappear in different forms in different cycles, and only a few entrepreneurs can survive and continue to develop in various cycles. Risun grows and grows with constant understanding of the regularity of the cycle, and has forged the ability to respond to the cycle, adapt to the cycle and navigate the cycle.

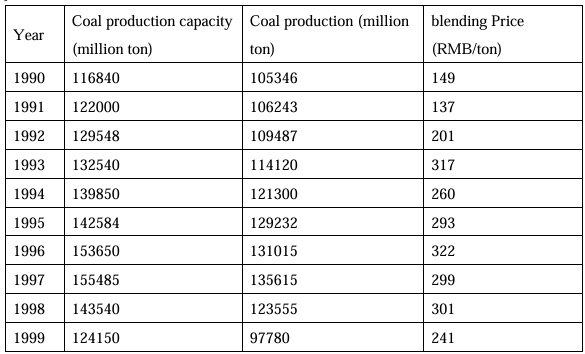

Table 13: China's Coal Industry, 1990-1999

Notes: 1. Source: National Bureau of Statistics; China Coal Resources Network;

2. Coal types of coal with coal production capacity and output are raw coal;

3. blending is the annual average price of clean coal;

4.1990-1994 blending Price is compiled based on data from Risun’s important supplier's Dongbang Coal Mine;

5.1995-1999 blending price was the blending price of Xingtai Risun.

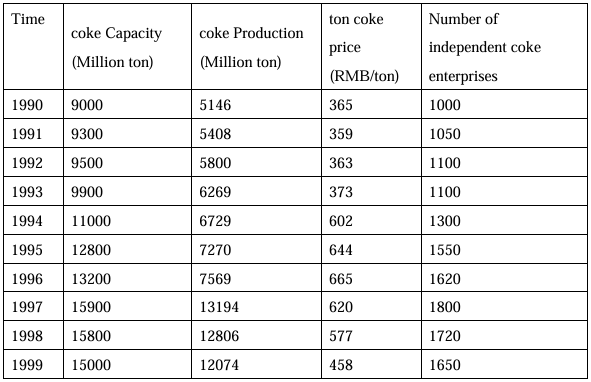

Table 14: China's coke Industry Overview, 1990-1999

Notes: 1. Source: National Bureau of Statistics; Risun Commodity Research Institute (a specialized institution for Risun industry research and market research, serving the survival and development of the Group);

2. The type of production capacity and output of coke is wet quenching;

3. ton coke price is the annual average price of wet quenching.

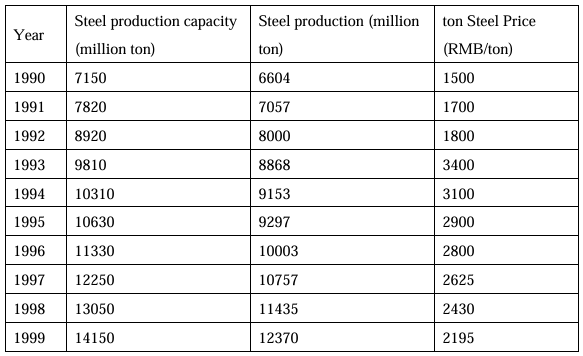

Table 15: Basic information of the steel industry in China from 1990 to 1999

Note: 1. Source: OECD; Risun (same as above);

2. Steel products with steel production capacity and output are steel billets;

3. ton Steel Price is the average annual price of steel billets.

In 1991, China's coke production ranked first in the world. In 1994, the annual production capacity of coke exceeded 100,000,000 ton. During this period, China's steel production was basically in a stage of stable growth, and coke production was also in a period of stable development. Since 1995, the overall coke market has been in a state of loss due to the rapid growth of production capacity and disorganized competition. For the Risun, which is at its initial stage, it will be a great time but a cloud. However, Risun has always believed that against the backdrop of accelerated industrialization and urbanization in China, coke industry will definitely have a broader space for survival. In order to better cope with market competition, Risun has carried out a series of explorations in corporate governance and business operations, and has accumulated certain practical experience for the formation of Risun's core capabilities and competitive advantages.

(1) Exploring ways to improve quality and reduce costs through technology. The Company introduced the most advanced mechanism coke technology in China at that time, and then took the lead in building the first tamping coke industry demonstration project in Hebei Province, and commercialized the tamping coking technology. While ensuring product quality, the Company increased the coal used for coal coking from 4 to 13, which significantly reduced production costs and created value for customers.

(2) Conduct large-scale research on the raw coal market. The marketing personnel of Risun carried forward the spirit of "staying around thousands of mountains and waters, giving thousands of words, doing everything possible, and overcoming thousands of dangers", negotiated with more than 300 coal enterprises in dozens of cities and counties in Shanxi, and finally reached a long-term cooperation intention with more than 20 of them. Since then, the Company has gradually carried out coal market research across the country, mastered the market distribution of all coking coal across the country, various indicators of coal and other information, and provided first-hand information for Risun's early coking blending cost reduction.

(3) put forward the business strategy of "zero inventory of products, no arrears in sales, and prices will follow the market". The "zero inventory" of products, the "bottom" of raw materials + the "minimum inventory", the "zero inventory" of spare parts and office supplies, and the "zero inventory" of all engineering materials have become important measures for Risun to prevent operational risks.

(4) Establish a project research department. The project research and development department is committed to conducting in-depth research on industrial history, industrial history, technical history, economic history, corporate history and other fields of developed countries such as China and the United States, Japan and Germany, aiming to provide comprehensive industrial development guidance for Risun through systematic research. At the same time, the project research and development department also continuously conduct systematic analysis on the characteristics of the national black industry chain to promote Risun to better understand the policy cycle, economic cycle, industry cycle, market cycle and company cycle in different development stages.

(5) Establish a multi-level meeting system and work supervision mechanism. Through meetings such as "morning meeting", "daily meeting", "weekly meeting" and "production, supply and marketing coordination meeting", the cadres and employees of Risun are allowed to: ① insists on carrying out the daily work card, and the daily work is completed and the daily work objectives are set for each employee; ② forms a standardized work and mechanism to ensure that information transmission is not excessive, work scheduling is not excessive, and business decisions are not overnight; Report major issues in a timely manner to respond quickly and effectively; ③ has developed a good style of action management and on-site management without leaving the scene; ④ has strict and efficient supervision over any work.

(6) A management review culture featuring Risun was created. "Management Review Meeting" is one of the most important forms of meetings of Risun, and a management review system of "annual review", "in-event review" and "instant review" has been gradually formed. Every cadre and employee of Risun has deeply analyzed themselves, and sincerely pointed out the shortcomings of others and put forward opinions and suggestions. From the perspective of value concept, the management review is even the core corporate culture of Risun, which goes deep into the bone marrow of Risun people and flows into the blood of Risun people.

(7) Establish a strict employment system to ensure the integrity of the team. Risun has formulated a strict employment system since its inception, which does not allow relatives of employees to enter the company, nor does it allow employees and their relatives to have any business dealings with Risun. Strict restrictions have also been imposed on the entry of the founder's relatives into the Company and restrictions was in place on business dealings between the founder's relatives and the Company. This red line ensures a fair, open and transparent promotion channel for all Risun employees within the Company, which is a strong guarantee for the integrity of Risun organization and the core of Risun organization's strong cohesion, execution and combat effectiveness.

(8) to establish a supervision and audit system and a proposed reporting mechanism. We require the majority of cadres and employees, including external customers, to continuously point out problems for Risun, the organisation itself, that is, to suggest reports, to constantly find problems, and to continuously eliminate some destructive, corrupt, and dishonest persons in the organisation, including those without performance, and to be eliminated thoroughly.

(9) Early implementation of comprehensive budget management in China. From October to December 1998, the Production and Operation and Financial Budget Target Plan for 1999 was prepared. Since then, the Company has gradually formed a standardized management system for the planning and implementation of annual budget, quarterly budget, monthly budget and profit and loss daily report, and carried out a series of targeted management changes, such as value enhancement work such as price spread management, inventory management, price management, and whole-process logistics control, forming a management method with the characteristics of Risun that is constantly iterating and improving with "goals, benchmarks, gaps and measures".

(10) To propose and formulate the "two first-class" development goals. That is, to "reach the first-class level of similar coke and coking chemicals plants in the industry in China and the first-class enterprise level in Xingtai City", and list the basic conditions such as the indicators and comparable data that reach the "two first-class" level, which has laid a foundation for Risun to continuously adapt to the times and exceed its own competition awareness.

(11) Create a standardized operation model guided by planning. In the first half of 1999, the Development Plan for 3.5 years (June 1999 – December 2002) of Xingtai Risun was prepared. The plan is the first development plan of Risun, which pioneered the standardized operation of Risun to plan and guide development, and has become the basis for the "two-year plan", "five-year development plan" and "ten-year development outline" of Risun's specifications since then.

(12) To propose the competitive strategy of "surpassing the industry average". Adhering to the path of high quality, high price and profit exceeding the industry average, the investment payback period is shorter than that of other coke and coking chemicals enterprises, and this is achieved by improving the service level, and improving our own operation level by finding differentiated customer services and methods that all operation processes are different from those of other enterprises, especially learning from companies with large products and sales to end customers. Based on the then development stage, the specific implementation will first determine the average line of the coke and coking chemicals industry in which it operates, and first reach the average line to strive for survival qualifications; Then, we exceeded the average line for greater development; It will then continue to grow until it becomes an industry leader.

(13) Carry out plugging activities of "running, dripping and leaking". In September 1999, in order to reduce costs, increase efficiency, strengthen management and eliminate waste, the Company conducted statistical investigations on all production and on-site links that are prone to leakage such as water pipes, oil pipes and process gas pipes, and found a total of 13704 points that are prone to leakage. Then, the departments were responsible and responsible to everyone, and self-inspections were mainly conducted, and joint inspections and mutual inspections were supplemented, which effectively eliminated all links of leakage and dripping, laying a foundation for the continuous improvement of Risun's intrinsic safety, essential environmental protection, refined management and cost management.

Risun was founded in Xingtai in January 1995 and was founded in the middle of this cycle from 1990 to 1999. After several years of hard work and tenacious survival, Risun achieved profitability despite the overall loss of the industry, the low technical level of the industry and the poor management level. The Company took the lead in the competition with more than 1600 independent coke enterprises, realizing advanced corporate governance, standardized business decision-making, marketing first, stable production, controllable product quality, stable cash flow and steady increase in profit. The Company completed the first round of closed-loop decision-making, closed-loop operation and closed-loop management, and initially formed the unique culture, values and management system of Risun. The Company has a stable team of employees, and established a single company model with a scale of 12 ten thousand ton coke and coking chemicals. In 1999, the production and sales volume reached 100,000 ton, and the operating revenue exceeded 50,000,000. Risun has achieved a breakthrough from scratch and from scratch. Being at the forefront of China's economic development, it has become a vivid force to promote social progress.

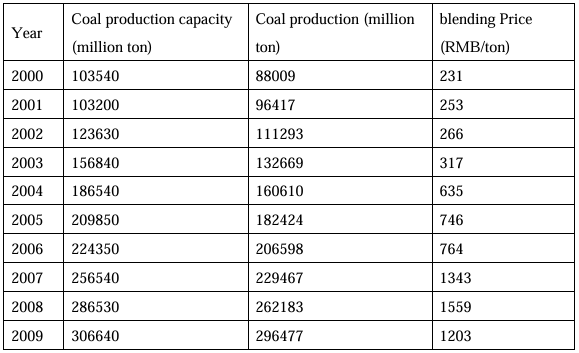

Table 16: Basic situation of China’s coal industry from 2000 to 2009

Notes: 1. Source: National Bureau of Statistics; China Coal Resources Network;

2. Coal types of coal with coal production capacity and output are raw coal;

3. blending is the annual average price of clean coal;

4.2000-2009 blending price was the blending Price of Xingtai Risun.

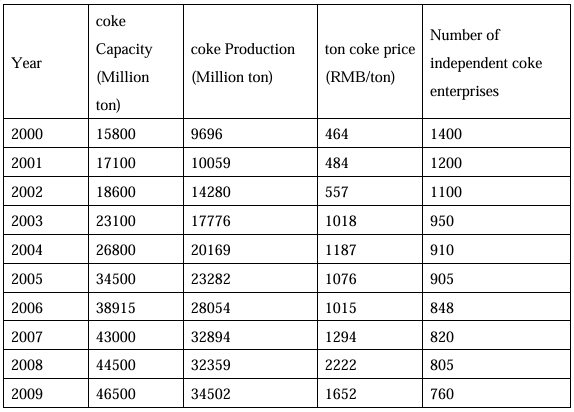

Table 17: China's coke Industry Overview, 2000-2009

Notes: 1. Source: National Bureau of Statistics; Risun (same as above);

2. The type of production capacity and output of coke is wet quenching;

3. ton coke price is the annual average price of wet quenching.

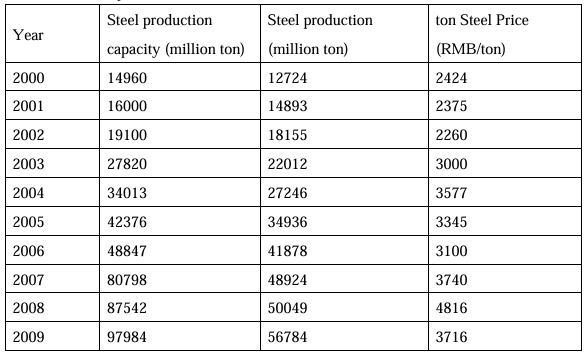

Table 18: Basic situation of China's steel industry from 2000 to 2009

Note: 1. Source: OECD; Risun (same as above);

2. Steel products with steel production capacity and output are steel billets;

3. ton Steel Price is the average annual price of steel billets.

From 2000 to 2009, the production capacity, output and price of the black industry chain all entered the fast lane of rapid growth. Risun assessed the situation and accurately grasped the development opportunities of this round of cycle. It has become the industry leader of coke, and has expanded from a company to a number of companies, embarking on the development path of collectivization. Risun has achieved leapfrog development in this cycle, thanks to its insight into the market, its understanding of policies, and its rapid adjustment of the Company's management system and operation mechanism.

(1) The proposal of "professionalism, refinement, strength and expansion". Through the strategic research and judgement on the age life of Western coke furnace and the internal needs of China's infrastructure construction, it is clarified that "there are 100 industries in the world, the best in coke and coking chemicals", adheres to the main business of coke and coking chemicals, and "professionalism, refinement, strength and expansion" of coke and coking chemicals. This logic has become the main logic guiding the development of Risun's industry, laying a solid ideological foundation for Risun to quickly become the first in the industry in this cycle.

(2) Set up the headquarters to guide the overall development of the Group. Risun chose to set up the headquarters in Beijing. Firstly, due to the great limitations of talents, information, vision and pattern in the place of entrepreneurship; Secondly, Risun is a company with great ambition. The future business will go to the whole country and the world, and all will be laid out and considered around this major goal.

(3) Establish a vertically integrated management model. In the process of development, according to the development objectives, strategic objectives, competition pattern, industry characteristics and organizational characteristics, the Company implements vertical integrated management in terms of strategy, investment and financing, finance, marketing, human resources, organizational structure, system process, automation and informatization, legal risk control, supervision and audit, culture, production technology, engineering management, etc., which essentially builds an integrated operation management from the Group to the Company's two levels of organization, and becomes the best and most reasonable management model of Risun at present.

(4) Acquisition of Baoding coke and coking chemicals Factory. The Company completed the acquisition of Baoding coke and coking chemicals Factory and established Hebei Risun Coke and Coking Chemicals Co., Ltd.. This is the first successful case of Risun's external mergers and acquisitions, and also lays the foundation for Risun to go out of Xingtai and expand to the whole country.

(5) Explore multi-equity cooperation methods. The joint venture with China Coal Group established Hebei CNC Risun Coke and Coking Chemicals Co., Ltd., which became a model of strong alliance between Risun and central enterprises, and also accumulated experience for the joint venture cooperation between the Company and other large enterprises since then.

(6) Establish a marketing integration business model of unified sales, unified procurement and unified logistics. The Company's marketing business is unified and centralized, the Company's sales and supply business and logistics are under unified management, personnel are unified adjusted, resources (customers) are unified arrangement, prices are unified, quality standards are unified, transportation is unified and coordinated, tasks are unified and division of labour, and external standards are unified.

(7) Coke ranked first in the world in terms of scale. In December 2003, Risun prepared the "Outline of Risun Group's Five-Year Development Strategy for 2004-2008", which for the first time proposed the development of 1,000 ten thousand ton of coke and coking chemicals, becoming the largest coke production supplier. The establishment of Hebei Risun and CNC Risun has achieved a leap from "One Risun" to "Three Risun". Subsequently, the Company developed into two major Production Base in Dingzhou and Xingtai respectively, and gradually formed the world's largest independent coke and coking chemicals enterprise with 500 ten thousand ton and single scale, thereby establishing the position of Risun World's largest independent coke producer and supplier.

(8) Establish a vision and objective model to guide the development of the Company. In December 2005, the Company prepared the "Outline of the Five-Year Development Strategy of Risun Group for 2006-2010", which proposed the idea of clarifying the Company's vision. In September 2007, it was determined that the company's vision was "to be the largest coke and refined chemicals product supplier in China and the world"; In September 2010, the Company changed its vision and goal to "make the largest coke and refined chemicals product supplier" when preparing the "Fourth Five-Year Development Outline" of Risun Group; On January 1, 2015, the vision was changed to "the world's leading energy refined chemicals company-Innovation leads the future".

(9) Establish a vertically integrated development model. The Company has gradually built a green circular economic industrial chain with the largest scale, the longest industrial chain, the widest product line and the most advanced technology, such as coal refined chemicals and petroleum refined chemicals, which are coupling and developing. The industrial chain gradient has reached level 6 or above, far higher than the average level of level 3 in the industry, and the added value of products has increased from RMB 1000 to more than RMB 60,000.

(10) To put forward the development idea of "coke + refined chemicals". On the 10th anniversary of the founding of Risun in 2005, after years of repeated argumentation and comparison, the Company selected the refined chemicals industry as an industry that continued to struggle. In 2007, the first Risun refined chemicals project was put into operation, starting the journey of investing in the coal refined chemicals industry, laying the foundation for the formation of the Company's second growth curve.

(11) To put forward the idea of Production Base development. The integrated development of Production Base has become the main carrier of the industrial development of Risun, adhering to the "five modernizations and seven unifications". "Five Transformations", namely integration, scale-up, intensification, ecology and intelligence, effectively ensuring the intensive, efficient, high starting point and high level of Production Base development; "Seven Unifications", namely, unified planning and development, unified operation management, unified infrastructure, unified energy management, unified logistics and transportation, unified safety and environmental protection, and unified R&D and innovation, effectively ensuring the unified planning, balanced development and complementarity of Production Base.

(12) extending the supply chain and sales chain overseas. We have successively exported the first batch of methanol products, realized the export of the first ship self-operated coke, realized the first independently operated import coking coal business, and opened up the channels of Risun's overseas supply chain and sales chain.

(13) Increase research and development efforts and build an innovation system. In 2007, with the commissioning of the first set of devices in the Risun refined chemicals industry, the Company put forward a new idea of R&D innovation and development, which is a summary and improvement of the development of the coke and coking chemicals industry solely relying on cost competition. The R&D and innovation system of the whole industry chain, the whole process and the whole process has been gradually established, which has opened up space for the Company's industrial development and improved quality. It has also laid the foundation for the Company to put forward the "three innovations" with business model innovation, institutional mechanism innovation and technological product innovation as the main content.

(14) Forming the methodology of "five unifications" for strategic management and "three steps" for strategy implementation internally. That is, the goal and method should be unified, the macro and micro goals should be unified, and the personal and organizational goals should be unified, so that Risun can condense the small win into great success, strengthen the hard work, step by step, break through the city, work hard to the end, and never shrink the organizational characteristics.

During the current cycle, Risun made a breakthrough and achieved excellent results. In 2009, the operating revenue of Risun Group under management was RMB 14,100,000,000, representing an increase of RMB 14,000,000,000 or 50166% as compared with that in 1999; Operating profit was RMB 730,000,000, representing an increase of RMB 750,000,000 or 7808% from 1999; EBITDA was $1,230,000,000, up $1,210,000,000 or 6050% compared to 1999; operation management (coke, refined chemicals) 16,300,000 ton, an increase of 6,300,000 ton, up 63%. At this stage, the number of Chinese independent coke and coking chemicals enterprises decreased from 1400 to 760, representing a decrease of nearly 46%, and the industry concentration increased significantly.

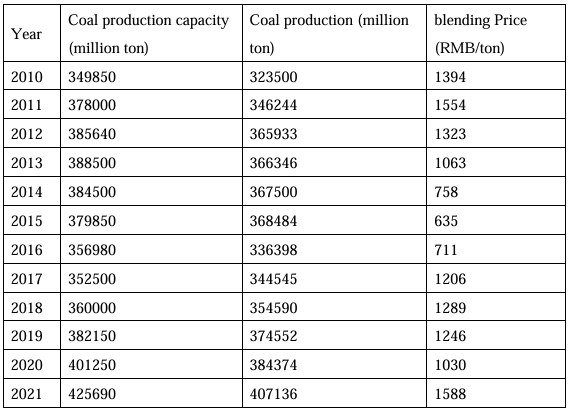

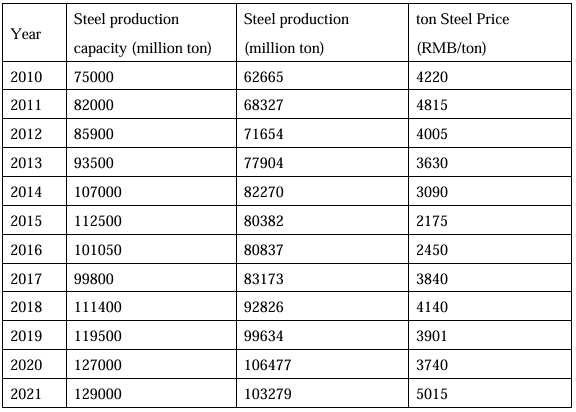

Table 19: Basic situation of the coal industry from 2010 to 2021

Notes: 1. Source: National Bureau of Statistics; China Coal Resources Network;

2. Coal types of coal with coal production capacity and output are raw coal;

3. blending is the annual average price of clean coal;

4.2010-2021 blending Price is the blending Price of Xingtai Risun.

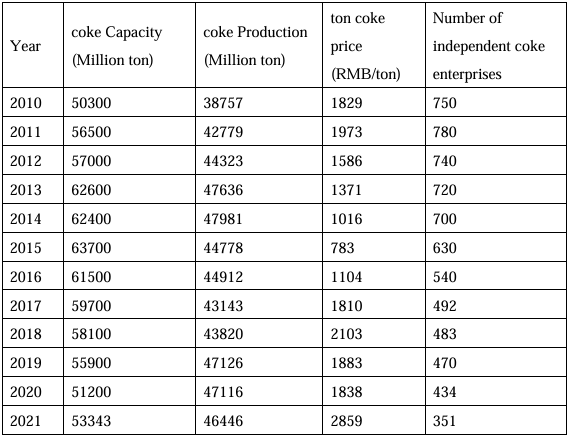

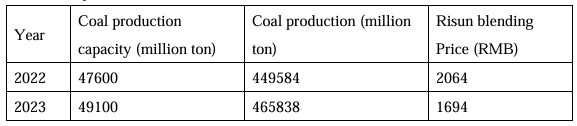

Table 20: Industry overview of coke from 2010 to 2021

Notes: 1. Source: National Bureau of Statistics; Risun (same as above);

2. The type of production capacity and output of coke is wet quenching;

3. ton coke price is the annual average price of wet quenching.

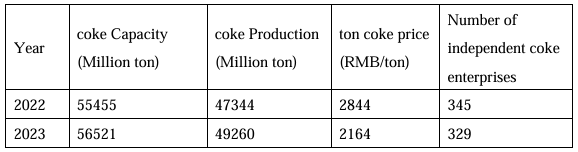

Table 21: Basic information of the steel industry from 2010 to 2021

Note: 1. Source: OECD; Risun (same as above);

2. Steel products with steel production capacity and output are steel billets;

3. ton Steel Price is the average annual price of steel billets.

In the third cycle, the production capacity and output of the black industry chain expanded simultaneously, and the price showed the characteristics of "decline first and then rise". In particular, from 2010 to 2015, in the process of continuous price decline in the coke industry, Risun also revealed some operational and management problems, such as the expansion of production and scale, the expansion of receivables simultaneously, and the increase in various costs of receivables; Investment is impulsive but profitability is not guaranteed; The lack of new investment directions has prompted the Company to put forward the general strategy of "adjustment, tapping, transformation and upgrading” on the basis of large scale, on the basis of multi-industries and under the background of group operation and management. After several consecutive years of hard work, concerted efforts and internal and external combination, the Company has jointly forged a series of unique core competitiveness of Risun, which has not only become a number of global first, but also greatly improved its profitability.

(1) Cultivate the refined chemicals industry into another pillar business segment of the Risun. Risun’s refined chemicals and coke and coking chemicals industries are independent, interconnected, mutually supportive, complementary and mutually synergistic. The coke and coking chemicals industry is more profitable than other coke and coking chemicals enterprises due to the synergy of the refined chemicals industry. The refined chemicals industry is also more profitable than other refined chemicals enterprises due to the support of the coke and coking chemicals industry. Since the first Risun refined chemicals device was put into operation in 2007, it has successively established and invested in refined chemicals Production Base, such as Laoting, Cangzhou, Yuncheng and Dongming, forming three major refined chemicals industrial chains of carbon materials, aromatics and alcohol and ammonia, and jointly creating the second growth curve of Risun. In particular, Caprolactam, with a production capacity of 750,000 ton, ranking second in the world, broke through the technical barriers of “bottleneck” in the downstream, and started to build a high-end polyamide new material project.

(2) Carry out systematic and comprehensive organisational changes. We promoted the concept of "flat operation and management", changed the traditional "straight-line functional" management model, shifted to specialisation and vertical integration, and changed from the original "olive-shaped" organisation to "dumb-bell-shaped" organisation. The Group implements a system of strong control and strong operation, strengthens marketing and research and development in a smile curve, and compresses production and manufacturing, transforming from the original production-oriented, market-oriented, demand-oriented, and customer-oriented.

(3) Pioneering the industry and achieving advance sales. On the basis of Risun’s persistence in zero inventory of products, all product lines have achieved 10-15 days of advanced sales, with long-term agreements signed for annual sales and quantitative non-pricing, which effectively guaranteed the safety of funds, accelerated the speed of capital turnover and saved capital costs. The advance sales to Risun not only contributed to the creation, but also changed the operating rules of the industry. It is the prerequisite for Risun to transform from a manufacturer to a supplier, service provider. There is no advance payment from sales and zero inventory of products. It is impossible for Risun to propose and implement the construction and improvement of the supply chain system of “sales, transportation, production and supply” with the focus on meeting customer needs. It is also impossible to propose and promote the national layout and global development of Risun business through various growth methods such as investment in new construction, operation management services, mergers and acquisitions after 2017.

(4) Establish a hierarchical customer management mechanism for strategic customers, key customers and market customers. The Group has accumulated a number of long-term, close, stable and high-quality customers, most of whom are industry leaders with strong competitiveness and stable cash flow, and the business proportion with strategic customers has reached more than 70%, which directly improved the brand influence of Risun in downstream industries, optimised the allocation level of Risun’s production resources, and enhanced the stability and safety of Risun’s cash flow.

(5) always promote the Company’s expansion based on customer needs. Provide customers with customised production services of "factory-to-factory" and "furnace-to-furnace"; Equipped with more than 30 blast furnace experts (steel experts) to provide customers with value-added technical services; The Company changed the past production capacity to promote development, and realised the integrated operation service of Risun sales, transportation, production, supply and research with customer customization and demand.