Dearest shareholders:

When I prepared this letter to shareholders, it was occasion that the China-U.S. tariff started with unexpected intensity, scale, and widespread impact, and its effects to future just began, casting further shadows over the already uncertain to economy of the world, China and U.S..

Since 2022, the Group's profits have started to plummet, and the profits of related industries as well as their upstream and downstream enterprises also declining. However, the Group's revenue, assets, production capacity, and business scale still increased consistently. Particularly in 2024, the Group's gross profit and cash flow are continuously growing. It is expected that revenue, assets, production capacity, business scale, gross profit, and cash flow will also continue to grow in 2025. This reflects the core capability of Risun developed over the past thirty years to navigate through cycles.

Currently, 2025 remarks the thirtieth anniversary of Risun, a time of flourishing achievements, vibrant appearances, budding ambitions, and the initial establishment of great undertakings. The external environment is extremely perilous, with an unclear outlook and uncertainty multiplied several times. For the past thirty years of Risun's entrepreneurship, we always faced the facts of uncertain environments, made progresses through barriers, and grew by overcoming difficulties.

The substantial wealth and spiritual culture created over thirty years by Risun have endowed the Group with a very rich entrepreneurial capability, enabling it to cope with any external uncertainties. Compared to the previous thirty years, external conditions are more determined, while the internal conditions of Risun are less determined; now, despite the increasing uncertainty in the external environment, the internal conditions of Risun are becoming increasingly certain, which is the fundamental reason why Risun can continue to grow.

Summarising the thirty-year entrepreneurial history of Risun, extracting the longevity genes and growth codes, placing Risun within the macro historical context for research and positioning, finding direction, determining goals, and establishing pathways and methods, this is the core of the "Risun Common Programme" released by the Group. This joint programme, which finds the logic and essence of inevitable success from the past occasional successes of Risun, will surely guide Risun to bravely embark on another thirty years of entrepreneurship.

Since the fourth quarter of 2021, the price of coke has been continuously declining, with the price platform moving downward, and the prices of steel and coal have also shown a similar downward trend. Since 2022, the Group has implemented a month-on-month cost reduction, thus continuously deepening cost-cutting and efficiency-enhancing measures, and comprehensively, systematically, completely, and thoroughly reforming its operational management. In 2024, new achievements were made, realising steady development across various businesses: the production capacity and output of refined chemicals and coke reached new highs; the revenue and profit scale of the refined chemicals segment once again surpassed that of the coke segment, becoming the largest Risun and the second growth curve, forming a relatively independent yet mutually complementary development pattern with the coke segment, jointly consolidating the industry-leading position of Risun; the scale of operation management service business experienced exponential growth; hydrogen business volume and profit doubled. Although net profit decreased in 2024 due to the narrowing of the price spread and the impact of non-recurring gains and losses, thanks to the relentless efforts of all Risun, a net profit of RMB 100 million was still achieved during the reporting period, far exceeding the industry level.

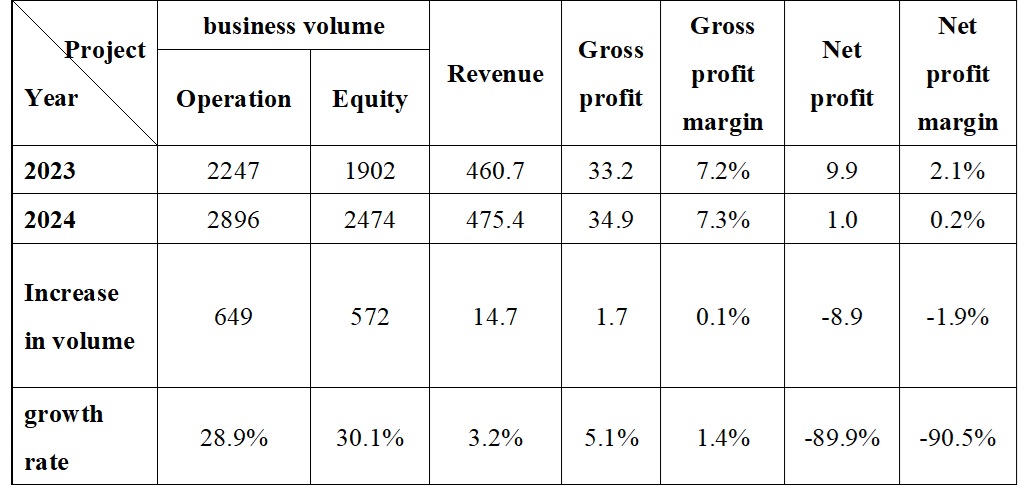

In 2024, Risun's business volume reached 28.96 million tons, an increase of 6.49 million tons compared to 2023, of which: the coke segment grew by 1.59 million tons, with a market share increase of 0.5 percentage points, reaching 5.5%; the refined chemicals segment grew by 210,000 tons; the hydrogen energy business increased by 10.8 million standard cubic metres; and the operation management service business increased by 4.68 million tons.

Benefit from the leapfrog growth of operation management services business volume, the net profit of the operation management segment surged in 2024, increasing by 1650% year-on-year, fully supporting Risun in its transformation and upgrading towards service-oriented manufacturing.

Table 1: Operating data of China Risun Group for the past two years

Unit: ten thousand tons, hundred million yuan

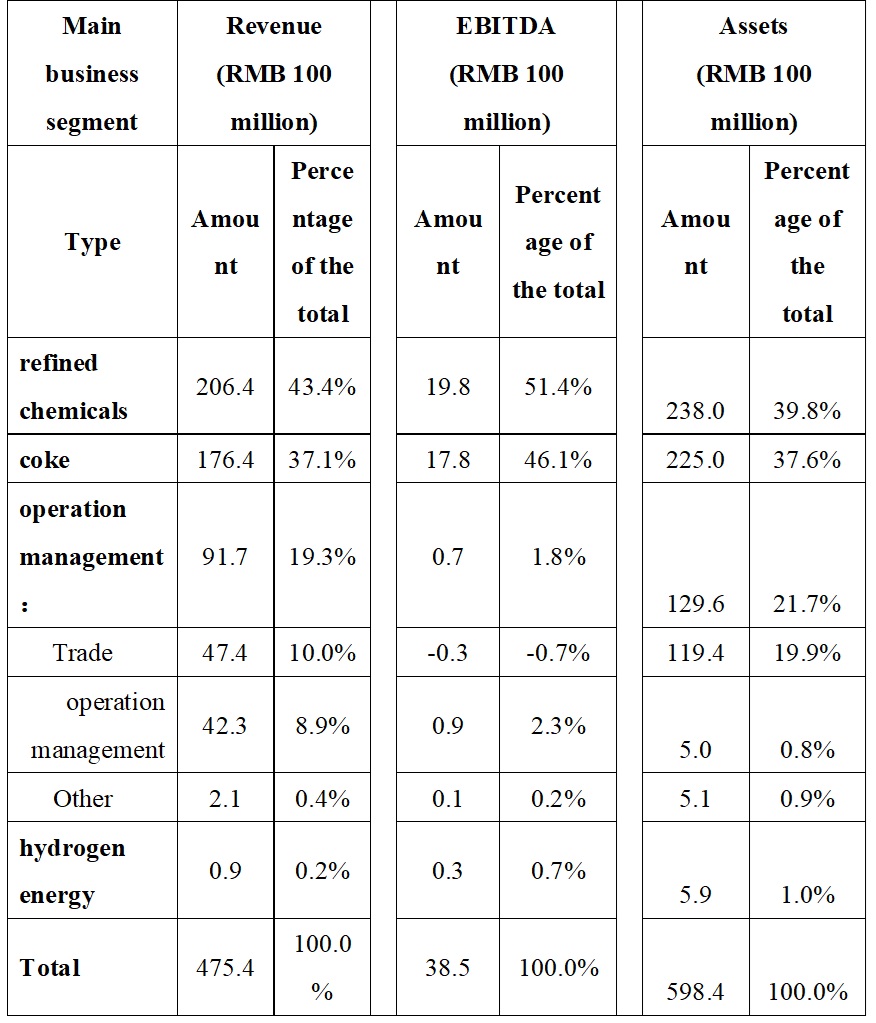

The specific performance of the four business segments of refined chemicals, coke, operation management, and hydrogen energy in 2024 is as follows:

1. Revenue and gross profit of refined chemicals both increased.

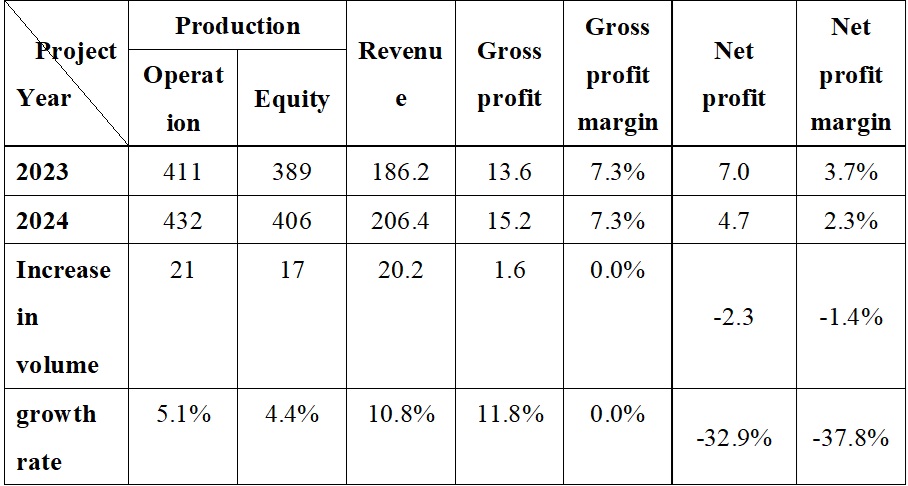

Table 2: Past 2 years operation data of the chemicals business of China Risun Group

Unit: ten thousand tons, hundred million yuan

In 2024, the chemical sector of Risun is expected to produce 4.32 million tons, an increase of 210,000 tons compared to 2023, representing a growth rate of 5.1%. Operating revenue RMB 20.64 billion, increased by RMB 2.02 billion compared to 2023, with a growth rate of 10.8%. Gross profit RMB 1.52 billion, increased by RMB 160 million compared to 2023, with a growth rate of 11.8%. The main reason for the increase in gross profit is that the sales of Caprolactam increased by 27,000 tons, coupled with the resumption of production at Dongming production base, which together drove the increase in gross profit of Caprolactam by RMB 210 million; the sales of styrene and synthetic ammonia increased by 46,000 tons and 240,000 tons respectively, contributing to the increase in gross profit by RMB 140 million and RMB 60 million.

In 2024, the export volume of Risun solid Caprolactam reached a new high, with an annual export volume of 47,500 tons, an increase of 200% compared to 2023, covering countries and regions such as South Korea, India, Indonesia, Vietnam, Colombia, Mexico, and Italy, fully entering the global supply chain. In the field of new materials, the latest high-value-added amino alcohol new materials developed by Risun achieved full production and sales during the pilot test process, with sales exceeding RMB 43 million, and have been sold to countries and regions such as the United States, Italy, Japan, South Korea, and India, bringing new profit growth points to Risun business.

In addition, the Risun 300,000 tons/year carbon-based new materials project has completed the entire process integration, producing qualified products such as three-component distillates, heavy washing oil, anthracene oil, modified asphalt, and industrial naphthalene, providing raw materials for the manufacture of fine chemicals and high value-added products such as dyes, pesticides, pharmaceuticals, resins, additives, and plasticizers, which can be widely applied in industries including manufacturing, agriculture, military, aerospace, healthcare, and consumer goods.

The refined chemicals sector has exceeded the coke sector in both revenue and profit for two consecutive years, continuously solidifying the foundation of the pillar business segment, with the contribution of the second growth curve steadily increasing. The coke and coking chemicals and refined chemicals industries are both independent and synergistic, representing Risun's unique industry and business model that leads globally.

2. The global expansion of coke and coking chemicals is beginning to show results.

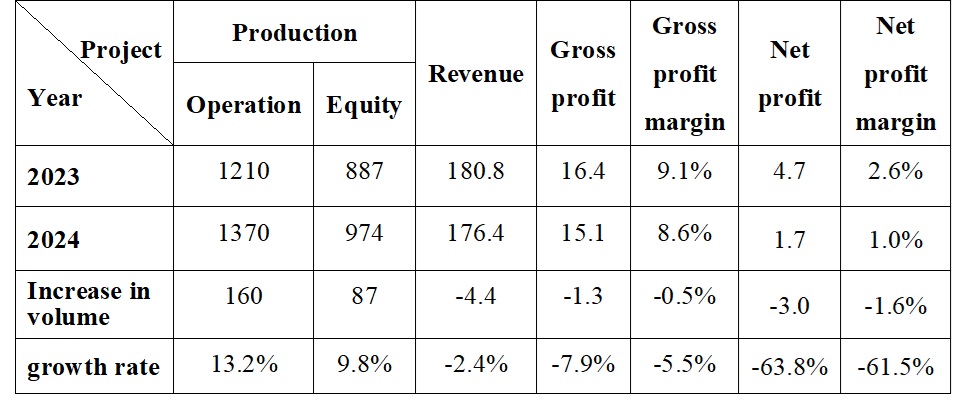

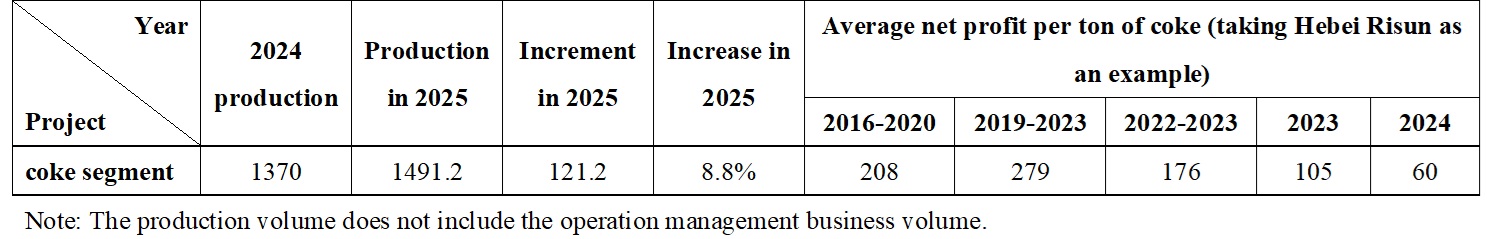

Table 3: Operating data of the coke business of China Risun Group over the past two years

Unit: ten thousand tons, hundred million yuan

In 2024, the coke production of Risun will be 13.7 million tons, an increase of 1.6 million tons compared to 2023, with a growth rate of 13.2%. coke produced, joint venture, operation management service business volume and service-oriented trade business volume of 17.03 million tons (excluding Risun Wei Shan 2.22 million tons), accounting for 5.5% of 309 million tons of metallurgical coke from independent coke enterprises in China (national independent coke enterprises, excluding coking coal commodity coke), with a market share increase of 0.5 percentage points compared to 2023.

Revenue from the coke segment decreased by RMB 17.64 billion compared to 2023, with a decline of 2.4%; gross profit decreased by RMB 1.51 billion compared to 2023, with a decline of RMB 130 million, representing a decrease of 7.9%. The main reason is that the downstream demand for coke continues to weaken, leading to a significant price drop. Throughout the year, there were 34 adjustments in total, with 11 increases and 23 decreases. The cumulative decrease for dry coke quenching was RMB 935 per ton, and the average price for the year decreased by RMB 411 per ton compared to the previous year, with a decline of 16.2%. At the same time, the upstream coal prices did not decline simultaneously, squeezing the gross profit, which led to a decrease in the net profit of the coke sector.

Against the backdrop of persistently weak domestic demand for coke, Risun made early arrangements and established Risun Sulawesi, Indonesia (hereinafter referred to as "Sulawesi production base") in 2021. Sulawesi production base is the first production base constructed by Risun overseas, working together with offices in Australia, Japan, Vietnam, Singapore, and India to develop a global supply chain system, forming an international strategic layout centred on Indonesia Risun Wei Shan that radiates to the global coke and coking chemicals industry. Currently, the Sulawesi production base has a total capacity of 3.2 million tons per annum, with sales of 2.22 million tons in 2024, covering 28 customers across 13 countries including Europe and Southeast Asia, generating revenue of USD 22 million, net profit of USD 15 million, ROE of 5.7%, and ROA of 1.4%.

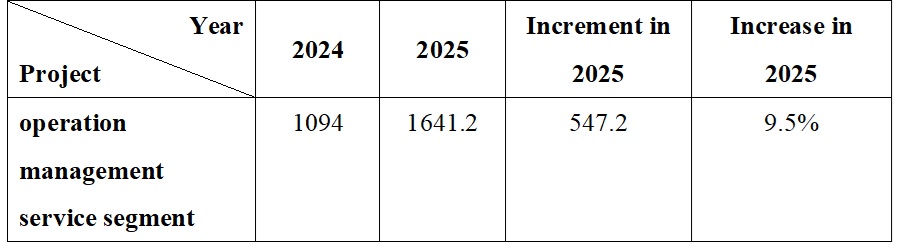

3. Expansion of operation management scale

Table 4: Recent 2 years operation data of the operation management services business of China Risun Group

Unit: ten thousand tons, hundred million yuan

Benefit from the leapfrog growth of operation management services business volume, in 2024, Risun achieved operation management sector business volume of 10.94 million tons, representing a year-on-year increase of 74.8%, becoming the core engine of Risun asset-light expansion. Revenue from the operation management segment in 2024 decreased by RMB 140 million compared to 2023, representing a decline of 1.5%; however, net profit surged, increasing by RMB 66 million, which is 17.5 times the net profit of 2023.

Based on its deep accumulation in the industry, Risun has refined, integrated, and solidified its experience and technology in the fields of coke and coking chemicals and refined refined chemicals, providing the industry with a replicable set of operation management services. This has gradually formed three models of management: production technology management, integrated marketing, and full industry chain and supply chain management encompassing "sales, transportation, production, supply, and research," offering clients flexible and efficient solutions and empowering the industry comprehensively.

The operation management services business has become an important sector for the Group's development and a new growth driver, fully promoting the Group's transformation and upgrade towards a service-oriented manufacturing industry.

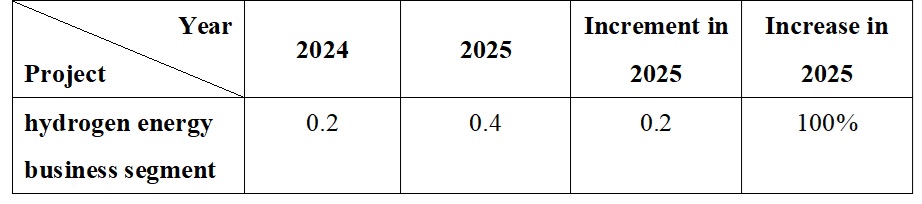

4. The hydrogen energy business continues to grow.

Table 5: Recent two years operation data of the hydrogen products business of China Risun Group

Unit: ten thousand standard cubic metres, hundred million yuan

Since the commencement of the Hydrogen Energy Phase I project in 2020, the business volume has achieved continuous doubling for four consecutive years, reaching 20.1 million standard cubic metres in 2024, an increase of 10.8 million standard cubic metres, representing a growth rate of 116.1%. Hydrogen energy business revenue reached RMB 90 million, an increase of RMB 30 million compared to 2023, with a growth rate of 50%; net profit was RMB 10 million, an increase of RMB 3 million compared to 2023, with a growth rate of 42.9%.

In 2024, Risun Hydrogen Energy, based on its strategic cooperation with the Beijing Aerospace Test Technology Research Institute of China Aerospace Science and Technology Corporation Sixth Academy (referred to as "Aerospace 101 Institute"), will build the first hydrogen expansion 5 tons/day hydrogen liquefaction system in Dingzhou production base, breaking through the technical barriers of liquid hydrogen and creating a liquid hydrogen demonstration project. In addition, the hydrogen production capacity of Risun has further expanded, with a total of 4 high-purity hydrogen production lines built and put into operation, amounting to 34 tons per day; the transportation capacity is 5.3 tons per day, covering the Beijing-Tianjin-Hebei region; one new hydrogen refuelling station has been added in Dingzhou, with 4 hydrogen refuelling stations operating steadily, totaling a refuelling capacity of 5 tons per day; 3 heavy truck routes and 142 logistics vehicles are operating steadily.

Overall, the net profit of the 2024 coke segment is RMB 170 million, the net profit of the refined chemicals segment is RMB 470 million, the net profit of the service segment is RMB 70 million, the net profit of the hydrogen energy segment is RMB 10 million, headquarters expenses are -RMB 590 million and non-recurring gains and losses are -RMB 30 million, totaling a net profit of RMB 100 million, which is a decrease from 2023 by RMB 890 million, primarily due to the reduction in profits for the coke and coking chemicals and refined chemicals segments affected by the narrowing of price spread, while the service and operation management business incrementally increased profits by RMB 70 million, along with an increase in headquarters expenses of RMB 180 million and a decrease in non-recurring income of RMB 250 million.

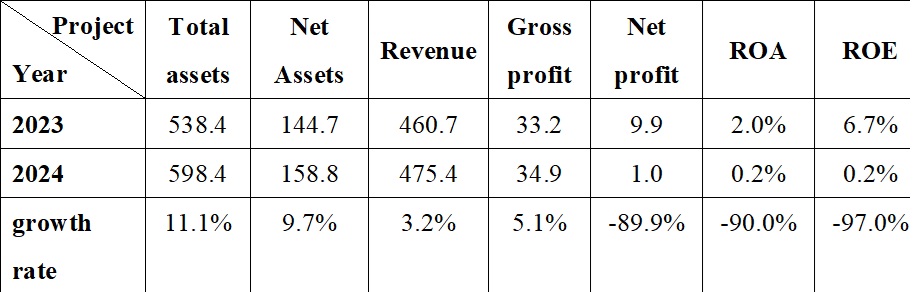

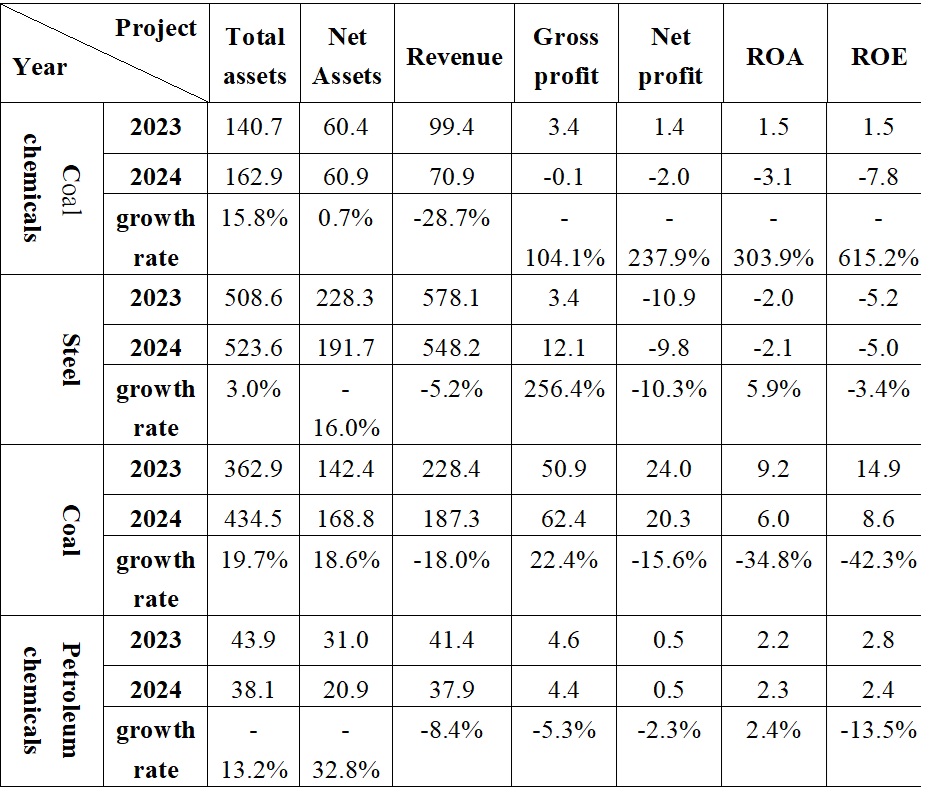

Table 6: Financial indicators of China Risun Group business in the past two years

Unit: RMB 100 million

Table 7 Financial Indicators of CITIC Coalrefined chemicals, Coal, Petroleum, and Steel Industries in the Past Two Years

Unit: RMB 100 million

The growth rates of financial indicators such as net assets, revenue, and gross profit for 2024 at Risun are all better than the median growth rate in the CITIC coal refined chemicals industry (hereinafter referred to as "same industry"); although the decline in net profit is significant, it is still far lower than the decline in median in the same industry; both return on total assets and return on net assets are higher than the median in the same industry.

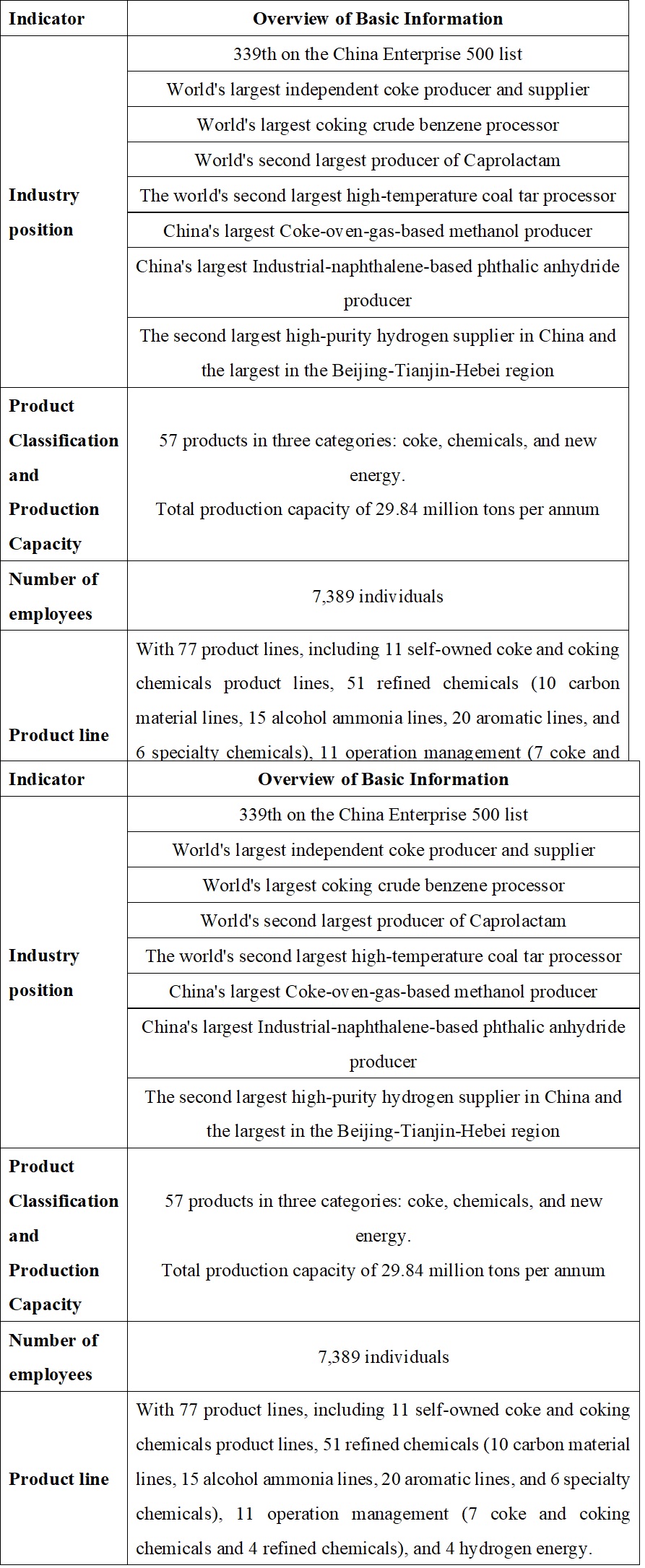

Since its sailing from Xingtai in 1995, Risun has developed multiple world-leading product lines through years of refinement and accumulation, becoming the world's largest independent coke producer and supplier, the largest global coke and coking chemicals crude benzene processor, the second largest Caprolactam producer, World's second high temperature coal tar largest processor, the largest producer of methanol from coal oven gas in China, the largest producer of industrial naphthalene-based phthalic anhydride in China, and the second largest in China and the largest high-purity hydrogen producer in the Beijing-Tianjin-Hebei area. In 2024, Risun will mobilise the entire industry to establish a brand cluster for coking coal coke and coking chemicals, strengthen collaboration to expand the influence of China's coke and coking chemicals industry brand, enhance industry self-discipline, increase industry concentration, and improve the overall level of the industry operation management, making a greater contribution to modernization with Chinese characteristics. Through the establishment of the brand cluster, the strong appeal and advantageous position of Risun in the industry have been further highlighted.

The achievement of the above results is a reflection of the Group's consistent implementation of the strategic guideline of "striving to be the world's number one in every industry we enter," and it also embodies the core competitiveness of Risun.

In 2024, Risun has achieved further enhancement of its core competitiveness and ability to navigate through cycles through steady operations and sustainable development amidst cyclical fluctuations.

(1) Coordinating safety and development at the bottom of the cycle. In the current market situation, with downward trends and increased risks, asset discounts and lower unit investment costs compared to 2021, lowering 35% present and with more opportunities for investment, mergers and acquisitions, and development. The Group focuses on the national layout and global expansion of Risun business, investing 3.2 million tons of coke in Indonesia Risun Wei Shan, increasing Caprolactam capacity from 450,000 tons to 750,000 tons, expanding Inner Mongolia Hohhot coke and coking chemicals to 3.6 million tons, and providing services covering regions such as Shanxi, Inner Mongolia, Jilin, Henan, Shandong, and Jiangsu. Independently develop solutions for "bottleneck" key technologies and accelerate the construction of the new materials project for hexanediamine and amino alcohol. The development of Risun adheres to a combination of long-term and short-term goals, utilising cyclical fluctuations under the premise of safety, which not only achieves sustained growth but also continuously enhances the return on assets.

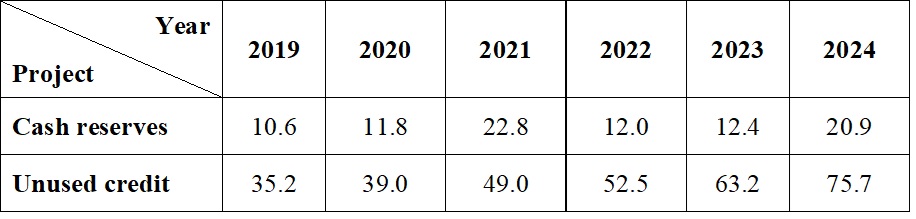

(2) Cash flow and cash reserves continue to improve. Since its listing in 2019, the cash reserves of Risun have continuously increased (Table 8), support from banking financial institutions has been steadily enhanced, and the unused credit facilities are abundant, supporting the long-term development of Risun investment planning, forming an important guarantee for the operational safety of Risun.

Table 8: Cash reserves situation from 2019 to 2024

Unit: hundred million

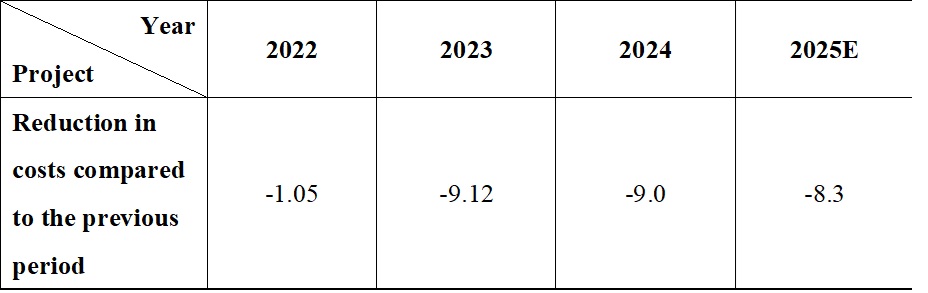

(3) Continuously implement systematic cost reduction and efficiency enhancement. Relying on measures such as technological innovation, process optimisation, streamlined organisation, and lean management, the reduction in costs compared to the previous period and the same period last year will be allocated to the company, workshops, departments, and individuals, forming a regular mechanism for cost reduction and efficiency enhancement. In 2024, the cash expenses are expected to decrease by RMB 900 million compared to the previous period (Table 9).

Table 9: Year-on-Year Cost Reduction from 2022 to 2025

Unit: hundred million

(4) Optimise the equity and debt structure comprehensively. Introduce strategic investor equity RMB 1.7 billion; optimise debt structure, comprehensive financing cost rate reduced 0.63%, financing costs reduced RMB 127 million.

Utilising the trends and patterns of industry cycles to accurately grasp asset price fluctuations and achieve long-term, stable, and sound development for Risun is our constant pursuit.

Since its listing six years ago, the uncertainty of the external environment has significantly increased. However, relying on thirty years of core competitiveness, Risun has steadily forged ahead without fear of challenges, achieving stable and excellent performance even in adverse external conditions.

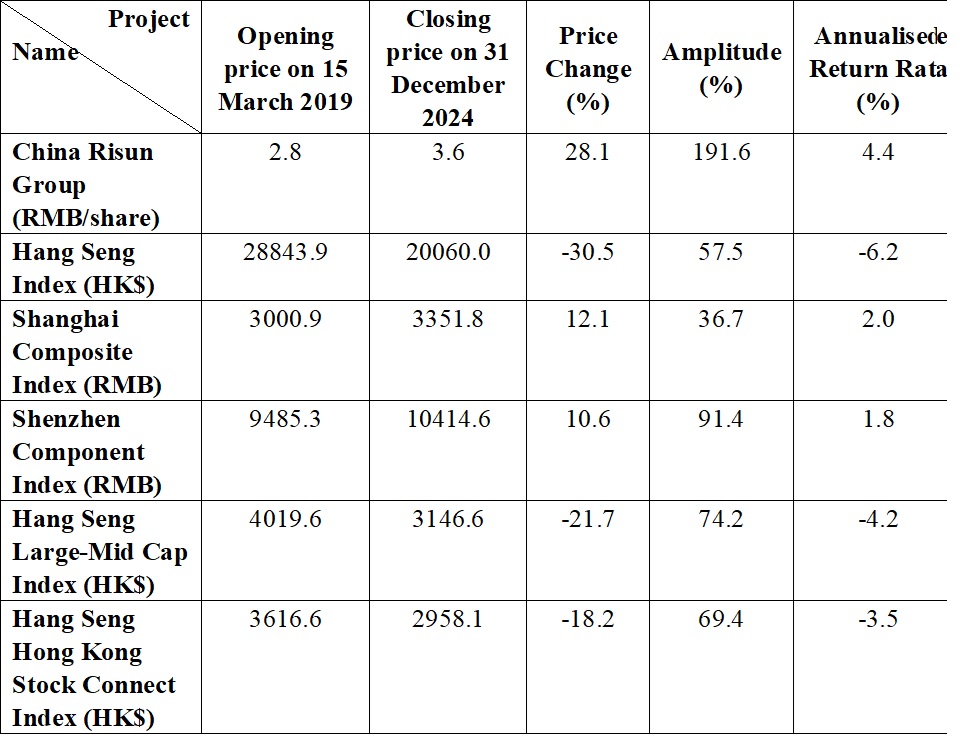

2024 is a year of significant fluctuations in the capital markets. In such a macro environment, the share price of Risun has still achieved stable growth compared to its initial listing price on 15 March 2019, with a six-year increase in share price calculated on a post-adjusted basis of 28.1% and an annualised return of 4.4% (comparing the closing price of the stock on 31 December 2024 to the issue price of RMB 2.8 on 15 March 2019), bringing tangible investment returns to investors. Based on the unadjusted price, as of 31 December 2024, the market value is RMB 12.29 billion, an increase of 9.8% compared to the initial listing of RMB 11.2 billion; based on the adjusted price, the current market value is RMB 15.97 billion, an increase of 42.6% compared to the initial listing.

Table 10 Performance of China Risun Group and major capital market indices

The net profit for 2024 of Risun saw a significant decline, yet the company still insisted on distributing dividends to shareholders, sending an important signal to the market about its robust cash flow and long-term operational confidence. Based on the 30th anniversary appreciation for shareholders and investors, the Company has decided to arrange a special dividend, totaling RMB 140 million for the year 2024, which is 1.4 times the net profit for this year.

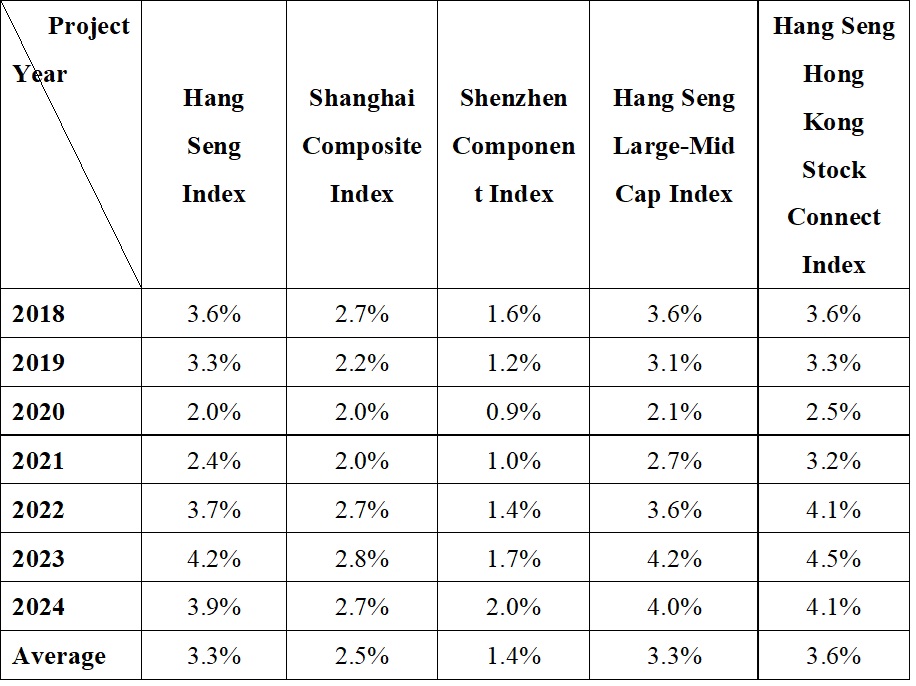

Since its listing, Risun has cumulatively distributed dividends to a wide range of investors 13 times, with a total dividend of RMB 3.94 billion, and an average annual dividend yield of 4.7%. Comparing the average dividend yield of major indices over the past six years, Risun achieved an excellent performance, surpassing the Hang Seng Index 42.7%, the Shanghai Composite Index 91.8%, and the Shenzhen Component Index at 232.0%. Many investors have also received tangible returns through their long-term cooperation with Risun.

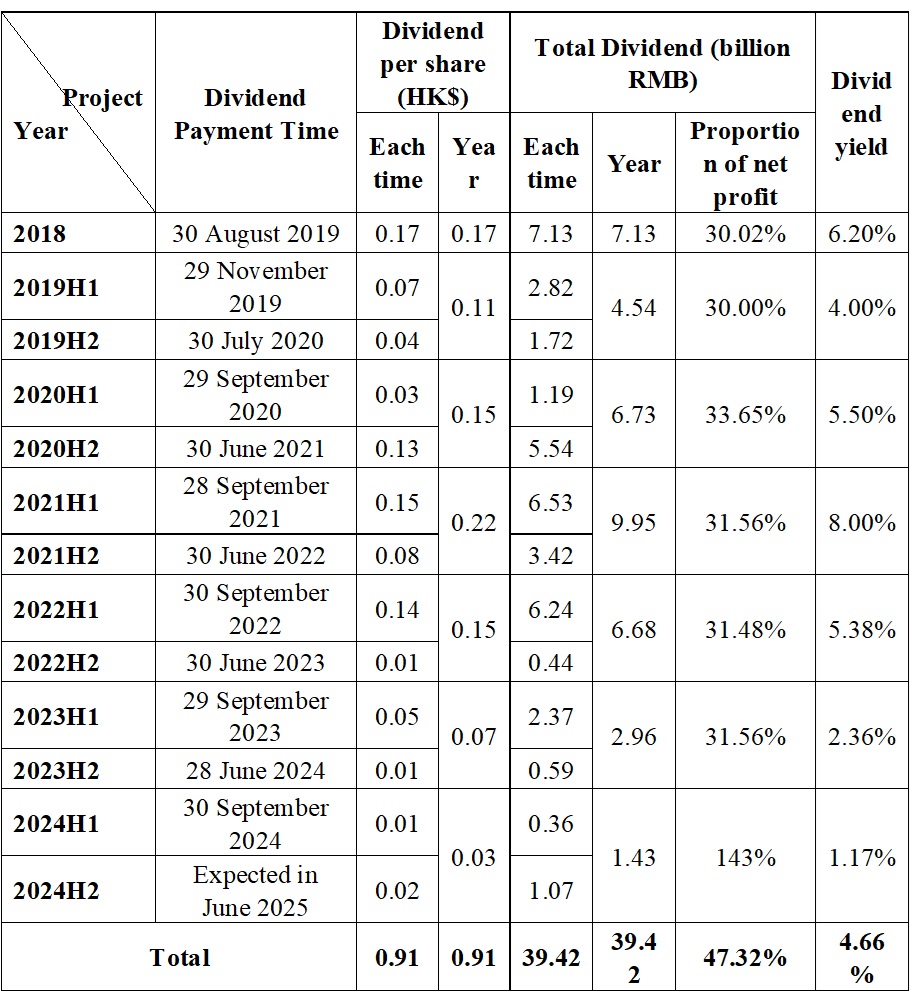

Table 11 Dividend Distribution of China Risun Group from 2018 to 2024

Note: The calculation of the dividend yield is based on the issue price per share of RMB 2.8 on the listing date, with the proportion calculated to four decimal places and then rounded to two decimal places.

Table 12 Main Index Dividend Yields of the Chinese Capital Market

Note: The data is sourced from the Wind database.

Risun entered the Hong Kong Stock Connect in 2019, and over the past six years, the holdings through the Stock Connect have continuously increased from 3.965 million shares as of 31 December 2019 to 303 million shares (as of 31 December 2024), an increase of nearly 75 times, accounting for 24.7% of the total issued share capital and 7.0% of the total number of shares in Hong Kong. Through the continuous introduction of strategic and financial investors, the equity structure of Risun has been continuously optimised, with public shares accounting for 28.6% of the total share capital, an increase of 20.2% compared to the initial public offering.

To further optimise the shareholder structure, Risun launched a placement plan on 18 December 2024 that prioritises existing shareholders. The Placing involved the issuance of 52 million new shares at a price of HK$ 3, raising a total of HK$ 154 million in funds, with the introduction of no fewer than six new shareholders, covering major institutions from Chinese state-owned enterprises, Hong Kong capital, and foreign capital, with the largest single holding being 20.8 million shares, and the top four investors collectively holding over 40 million shares, accounting for more than 80%. After the completion of this placement, the control of Risun remains stable, the newly issued shares have no special rights restrictions, and the rights of existing shareholders are fully protected.

Risun places great importance on communication with investors. Over the past six years, it has conducted more than 1000 roadshows to domestic and foreign institutions, with over 800 institutions participating. Domestic and foreign investors and analysts have responded positively, receiving coverage from several brokerage firms including Founder Securities, Debon Securities, Tianfeng Securities, CITIC Securities, Guotai Junan, and Guozhen International, and have been given a "buy" rating by Risun. With outstanding performance in the capital markets, Risun won the Best Capital Market Communication Award, the Tianma Award for Hong Kong Listed Companies, the Best Hong Kong Stock Connect Company, and the Most Socially Responsible Listed Company Award in 2024, marking its sixth consecutive appearance on the Fortune China 500 List of Listed Companies.

Since 2020, the average daily trading volume of Risun has remained stable at over 3 million shares, with market activity steadily increasing. It has successively become a constituent of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and has been included in 27 important indices, including 22 indices in the Hang Seng series, 3 indices in the FTSE Global Equity Index, and 2 indices in the MSCI Morgan Stanley, receiving widespread recognition from the capital market.

On 17 December 2024, Risun signed an investment agreement with Shenzhen Capital Group's New Materials Fund for Manufacturing Transformation and Upgrading (Limited Partnership) (referred to as "Shenzhen Capital Group"). As a strategic investor, Shenzhen Capital Group invested in the subsidiary Cangzhou Risun Chemical Co., Ltd. RMB 800 million, supporting the company's transformation and upgrading of its nylon new materials business.

Shenzhen Capital Group is a specific vehicle for the National Manufacturing Transformation and Upgrade Fund. Its selection of Risun as an investment target confirms the country's recognition of Risun in the direction of new materials, which is beneficial for accelerating the domestic substitution process of high-end nylon new materials and optimising the capital structure. Through the capital increase agreement, RMB 800 million capital injection into RMB 632 million will be credited to the registered capital, directly enriching the equity capital, while the remaining funds will be used as capital reserves. The registered capital of Cangzhou Risun increased from RMB 3.584 billion to RMB 4.216 billion, significantly enhancing its capital strength.

Risun has always respected all shareholders and investors, viewing the capital market as an important window and channel for communication between the company and the outside world. In the future, Risun will continue to strengthen interaction and communication with the capital market, actively responding to investors' concerns and expectations, and bringing richer returns to shareholders and investors.

Becoming an excellent and outstanding listed company, continuously creating value for investors and shareholders, while continuously improving the dividend mechanism and enhancing the market value of Risun is our eternal pursuit.

Risun was founded in early 1995, driven by a greater pursuit of life ideals, not out of compulsion to start a business or to improve living conditions, but purely to pursue a greater life ideal. Therefore, the entrepreneurship of Risun has chosen to strive together with employees from the very beginning, and the purpose of entrepreneurship is to pursue organisational success, which is a distinct characteristic. Because only one organisation can continuously grow and succeed, it can build lasting vitality and satisfy the pursuit of greater life ideals.

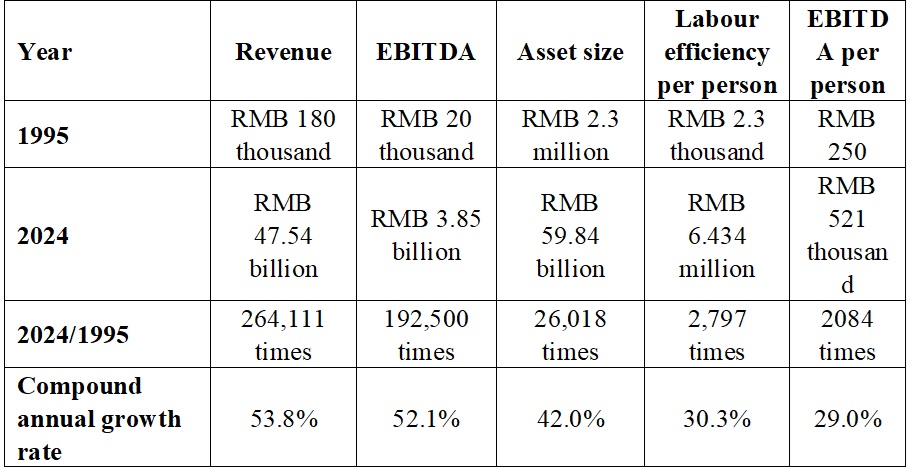

Thirty years ago, Risun decisively chose to start a business amidst the tide of the times, starting from scratch, from nothing to something, growing from small to large and from weak to strong through repeated entrepreneurial cycles. In 1995, we raised funds of RMB 2.3 million to recruit and attract 80 employees to join Risun, fighting our way through challenges; by 2024, revenue exceeded RMB 47.54 billion, with an average annual compound growth rate exceeding 53%, asset scale nearing RMB 60 billion, and an average annual compound growth rate reaching 42%. Behind this leap is the dual drive of strategic determination and innovative capability. As the world’s largest independent coke producer and the second largest Caprolactam supplier, we not only hold a leading position in the industry with a total production capacity of nearly 30 million tons per year but have also achieved a green upgrade of our traditional business. The revenue share of the refined chemicals sector reached 43.4%, and the layout of high-end products such as carbon materials and aromatics is gradually breaking the cyclical constraints of bulk commodities. The three major sectors of coke, refined chemicals, and new energy collaborate, allowing for the maintenance of profitability flexibility even during the winter period of industry overcapacity through dynamic adjustments of resource allocation across 77 product lines.

If production capacity is the measure of a company's hard power, then the compounded accumulation of talent and technology is the true key to navigating through cycles. In 1995, there was only 1 employee with a college degree among our staff, and there were no doctoral or master's talents; now, an innovative team led by 48 doctors and 282 masters has emerged, and the qualitative change in talent density has directly driven the construction of technological barriers. We have established 10 group research institutes, owned 8 national-level high-tech enterprises, equipped with 130,000 square metres of pilot test bases and 20,000 square metres of laboratories, formed 337 patented technologies and 520 proprietary technologies, and achieved the industrial transformation of 27 independent research and development projects. At the same time, we empower external enterprises with 11 production lines by outputting operation management service standards of Risun, elevating our own experience to become an industry benchmark. Looking to the future, we will deepen our global layout, increase overseas investment, extend our supply chain and sales chain overseas, and achieve the vision of "The World’s Leading Energy refined chemicals Company – Innovation Leads to the Future."

Table 13: Overview of the 30-Year Basic Situation of China Risun Group

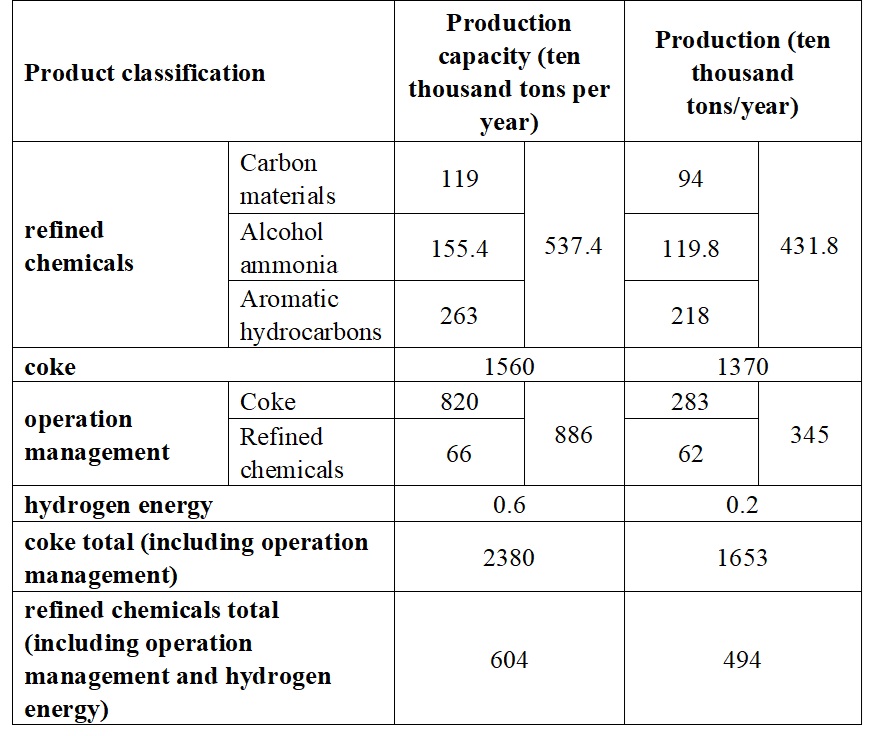

Table 14: Production and sales capacity of China Risun Group in 2024

Table 15: Operating status and scale of China Risun Group in 2024

Table 16: Comparison of the operational performance of China Risun Group over 30 years

Table 17: Comparison of the personnel structure of China Risun Group over 30 years

Thirty years ago, amidst the tremendous changes in society, we seized the historical opportunity, bravely ventured into entrepreneurship, and made the most correct choice. Over the past thirty years, we have accurately positioned ourselves in the grand tide of the times, steadfastly adhering to the correct direction, persisting on the right path, and upholding the right strategy. We have forged ahead through difficulties and hardships, creating extraordinary achievements and accumulating substantial material and spiritual wealth.

Although the genetic and growth codes of Risun are innate, they can only be accepted, inherited, promoted, and enhanced by the broad cadre and employees when combined with the事业 of Risun, thus becoming the genetic and growth codes of the organisation. In the process of co-entrepreneurship, creation, and innovation, we have generated the genes and growth codes of Risun.

In the process of entrepreneurship, creation, and innovation, we have learned to identify direction, position ourselves, and choose paths.

In the process of entrepreneurship, creation, and innovation, we have cultivated the worldview, values, and corporate philosophy of Risun.

In the process of entrepreneurship, creation, and innovation, we have developed our own business model, operational model, product, and service model.

In the process of entrepreneurship, creation, and innovation, we have formed our own institutional mechanisms, governance models, operational mechanisms, and management models.

In the process of entrepreneurship, creation, and innovation, we have cultivated a team of entrepreneurs, developed Risun leaders, and formed a distinctive team of cadres and employees, with Risun becoming the core of the Risun entrepreneurship.

In the process of entrepreneurship, creation, and innovation, we have formed the spirit of Risun, the ideals of Risun, the beliefs of Risun, the philosophy of Risun, the purpose of Risun, and the culture of Risun, which have become the spiritual driving force and inexhaustible source of strength at the core of the Risun organisation.

In our process of entrepreneurship, creation, and innovation, we adhere to the combination of lofty ideals and short-term goals, the integration of macro and micro perspectives, and the unity of knowledge and practise, while maintaining self-criticism. This unique strategy and tactic of Risun is the methodology for the survival and development of Risun.

In the process of entrepreneurship, creation, and innovation, we have developed distinctive core capabilities and core competitiveness of Risun, continuously progressing, with no success but only growth, striving to win both competition and the era.

In the process of entrepreneurship, creation, and innovation, we voluntarily and consciously form a community of shared interests, a community of shared endeavours, and a community of shared destiny with a wide range of cadres and employees. These three communities are the fundamental guarantee for the sustained prosperity of the Risun entrepreneurship.

The common programme of Risun is less about being summarised and refined, and more about being jointly fought for and created by the vast number of cadres and employees. It is the fundamental law of Risun, highly condensing all the spirit and cultural core of Risun. It is not only the cultivation principle for the "inner sage" of the Risun organisation, but also the fundamental guideline for the "outer king" of Risun.

For thirty years, Risun has created value for customers and contributed to society while generating, shaping, exercising, and strengthening itself. With the material and spiritual accumulation of the first thirty years, Risun will surely move towards a brighter future.

The revenue and profit growth in 2025 mainly includes two aspects: first, the increase in production and sales volume leads to an increase in total profit; second, expanding income, reducing costs, and increasing profits contribute to the increase in revenue and profit. The total target for increasing revenue and reducing costs to increase profits in 2025 is RMB 2.03 billion. The achievement of these goals requires strong support from effective operational management reform measures.

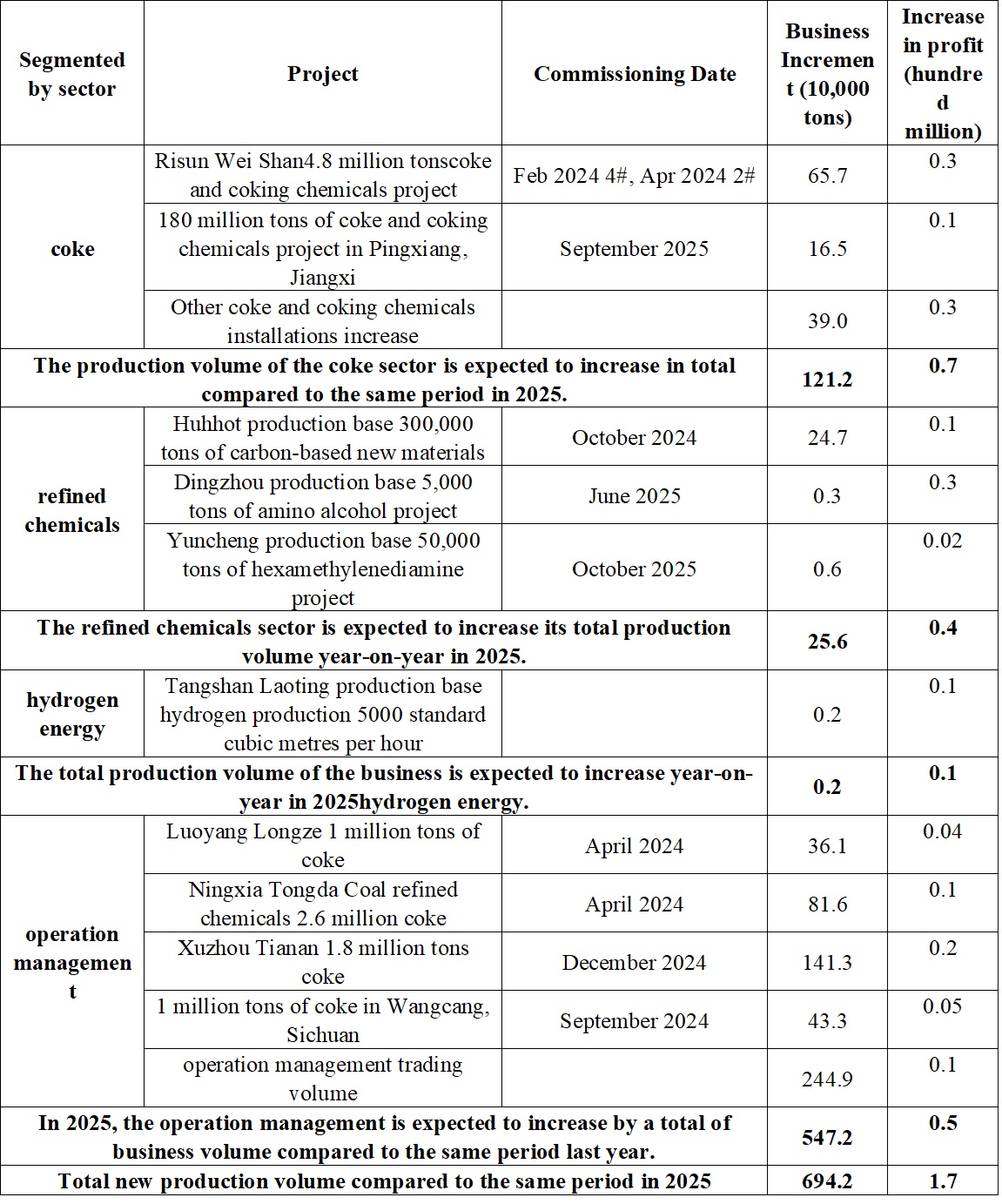

In terms of performance growth: apart from the need to explore the business volume of the operation management sector, the output of other sectors such as coke and coking chemicals and refined chemicals is certain, and the business volume of the services provided by operation management is also expected to be fully achievable. It is expected that the overall business volume of Risun in 2025 will increase by 6.942 million tons, with total increasing volume of all segments by RMB 170 million — coke segment increasing by RMB 70 million, refined chemicals segment increasing by RMB 40 million, hydrogen energy segment increasing by RMB 10 million, and operation management segment increasing by RMB 50 million.

In terms of increasing revenue and reducing costs to enhance profits: various external receivables and the implementation of subsidy policies will increase RMB 740 million; revenue will be increased by adjusting product structure and inventory control measures RMB 300 million, while continuously tapping into internal potential to reduce costs and save expenses RMB 830 million.

Although the international economic environment is facing the impacts of tariffs and various factors, the industry situation remains unfavourable. However, Risun has developed very comprehensive and detailed countermeasures. Just like the several cyclical adjustments that Risun has gone through over the past thirty years, we firmly believe that we will achieve better results in 2025 than in 2024.

The projected new projects in 2025 and the details of the increased profits are as follows:

business volume

Table 18 Expected Additional Production in 2025 for China Risun Group

The specific explanations for the business volume and profit growth of the four sectors of refined chemicals, coke, operation management, and hydrogen energy are as follows.

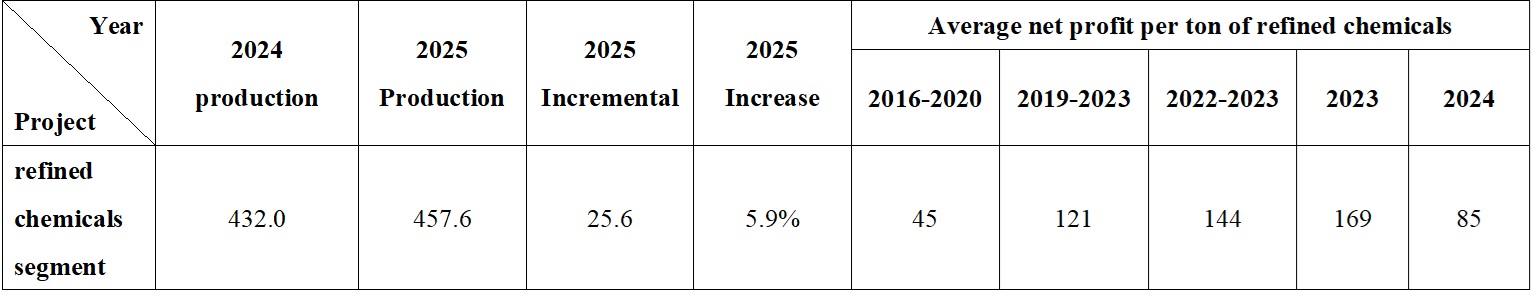

1. The launch of the new refined chemicals project increases profits.

Table 19: Expected business volume of the chemical segment of China Risun Group

Unit: ten thousand tons, yuan

In 2025, while consolidating the advantages of the core business of coke and coking chemicals, the refined chemicals new materials business will also make progress. The Risun chemical sector is expected to add a production volume of 256,000 tons, which includes the Hohhot production base 300,000 tons per year carbon-based new materials project, expected to add 247,000 tons business volume; the Dingzhou production base 5,000 tons per year amino alcohol project, expected to add 3,000 tons business volume; and the Yuncheng production base 50,000 tons per year CTH project, expected to add 6,000 tons business volume.

Specifically, the self-developed and designed 50,000 tons per year CTH project is expected to commence production in the second half of this year, gradually expanding into high-end new materials such as PA6, PA66, and high-temperature nylon, establishing an absolute leading position as the global number one in nylon new materials, ensuring stable profit growth. The amino alcohol new materials business has already achieved explosive growth in overseas markets. After the launch of the 5,000 tons/year amino alcohol project in Dingzhou production base, future capacity will be further expanded to 20,000 tons/year. At the same time, continuous research and development of innovative applications for different grades of amino alcohol series products in various scenarios, such as 3-amino-4-octanol and 2-dimethylamino-2-methyl-1-propanol, will create the world's leading amino alcohol product line and open up new profit space in the refined chemicals sector.

2. Increase production, increase revenue, increase profit.

Table 20 Expected Production of Coke Sector for 2025 China Risun Group

Unit: ten thousand tons, yuan

In 2025, the production capacity of the Risun coke segment will continue to grow, with an annual output expected to reach 14.912 million tons, an increase of 1.212 million tons compared to 2024: Indonesia's Risun Wei Shan output is 2.877 million tons, an increase of 657,000 tons; the Jiangxi Pingxiang 1.8 million tons coke and coking chemicals project is expected to commence production in September 2025, increasing output by 165,000 tons; other coke and coking chemicals facilities will see an increase in output of 390,000 tons.

In 2025, Risun will continue to respond to the "Belt and Road" initiative, based in Risun Sulawesi, Indonesia production base, to expand its global marketing network; establish strategic cooperation with overseas shipping companies to improve transportation efficiency and reduce transportation costs; choose the appropriate time to collaborate with international partners to build global production bases; expand the coal database and establish long-term agreements with more international coal mines, globally selecting coal types to reduce blending costs.

3. The scale of operation management expansion accelerates industry consolidation.

Table 21: Expected business volume of the operation services segment of China Risun Group in 2025

Unit: ten thousand tons

In 2025, the scale of the operation management services business will continue to expand based on 2024, with the operational management capacity target for the coke sector aiming to increase by another 10 million tons, reaching 18.2 million tons; the operational management capacity plan for the refined chemicals sector aims to increase by another 1 million tons, reaching 1.66 million tons. In addition, we will expand the light asset operation management projects overseas, allowing the "Risun model" to integrate into the global industrial chain, increasing the share of the operation management service sector in the Group's total revenue, total profit, and total scale, with an expected average net profit per ton of RMB 18 in 2025.

Service-oriented manufacturing is a polymer of knowledge capital, human capital, and industrial capital, with its core lying in breaking traditional production boundaries and integrating services throughout the entire production cycle. The operation management service business model of Risun has broken down the barriers between traditional manufacturing and modern service industries, creating a flexible service system that not only avoids the risks of heavy asset investment but also enhances market share through industry integration. 2025 will be a year of accelerated consolidation in the coke and coking chemicals industry, with Risun prioritising companies with profit potential or established sales channels as targets for operation management services, creating synergistic advantages with the Group's own production capacity, accelerating industry consolidation with a light asset model, and increasing the Group's revenue.

4. Expand the hydrogen energy industrial chain and broaden the scope of operations.

Table 22: Expected business volume of the hydrogen sector of China Risun Group in 2025

Unit: ten thousand tons

In 2025, the sales volume of hydrogen for Risun is expected to reach 40,000 tons, an increase of 20,000 tons compared to 2024, representing a growth rate of 100%. This year, Risun will continue to implement the "1124" strategic plan, utilising interconnected distributed photovoltaic power generation, continuously developing PEM electrolyzer equipment for water electrolysis to produce hydrogen, and planning the phased implementation of green hydrogen projects, linking the refined chemicals sector to produce green methanol, green synthetic ammonia, and other products. Launch the construction of the first 5 tons/day liquid hydrogen facility in the country, creating a benchmark project for liquid hydrogen facilities nationwide. Planning the natural gas pipeline hydrogen blending project; proposing to plan and construct 2-3 hydrogen refuelling stations in the Beijing-Tianjin-Hebei and Inner Mongolia regions; increasing the planning for the master hydrogen refuelling station in Daxing, Beijing, to create a "liquid hydrogen + gaseous hydrogen" supply base by leveraging the construction of the liquid hydrogen project.

In the face of increasingly severe external market conditions, in 2025, the company will achieve a growth of 6.942 million tons in business volume and an increase in profit of RMB 170 million. The company will continue to expand revenue, reduce costs, and increase profits, and will establish clear, strict, and detailed goals and measures.

1. External collection revenue target RMB 740 million

The plan for 2025 is to complete the collection of various external debts RMB 440 million and to implement various reward and subsidy policies RMB 300 million.

2. Adjustment of product structure, inventory management revenue target RMB 300 million

⑴ The overall sales revenue rate increased by 0.5%, expanding price spreadRMB 67 million;

Reduce the loss rate of raw coal procurement 0.5%, expand price spreadRMB 13 million;⑵

⑶ Through the inventory of raw materials and products, expand price spreadRMB 48 million;

Adjust the product structure towards high value-added products, expand price spreadRMB 40 million;⑷

Adjust the customer structure towards high-yield customers, expand price spreadRMB 38 million;⑸

⑹ expand the export of refined chemicals products business volume, expand price spread RMB 32 million;

⑺ Expand the service-oriented trade volume relying on operation management services and factory operations (coke 3.2 million tons, refined chemicals 2.18 million tons), increasing revenue of RMB 65 million.

3. Continuous cost reduction in internal potential mining section RMB 830 million

In 2025, it is expected to reduce cash costs by RMB 830 million, including: a reduction in manufacturing expenses of RMB 280 million, a reduction in selling expenses of RMB 49 million, a reduction in transportation expenses of RMB 200 million, a reduction in administrative expenses of RMB 62 million, and a reduction in financial expenses (rate) of RMB 230 million. Risun is implementing and preparing to implement 11 technological transformation projects, generating an annual profit of RMB 210 million.

Technological innovation and management innovation have become important levers for Risun to reduce costs and increase efficiency. Through these two major measures, not only must we ensure significant growth in profits and revenues in 2025 compared to 2024, but we must also ensure that the Group's strength is enhanced and competitiveness is improved at the bottom of the cycle.

In 2025, Risun will continue to implement the "Guiding Opinions on the Group's Management Reform" (twenty-four articles) formulated and executed by the Group in 2024, with the aim of "controlling investment, expanding income, reducing costs, and increasing profits." The breakthrough will focus on comprehensive, systematic, and thorough rectification of cadres, using measures such as reducing companies, compressing levels, merging departments, and optimising personnel. The means will involve extensive application of digitalization and intelligence, with graded authorization, gradual authorization, and limited authorization. Responsibilities and accountability targets for cadres will be clearly defined, strengthening the risk control system, improving institutional processes, reducing approval steps, and enhancing execution efficiency. This will lead to comprehensive reform, systematic reform, and thorough reform, improving per capita profit, per capita income, per capita output, per capita monthly order volume, per capita cost control, and per capita R&D results, while comprehensively forging the basic strength of Risun and enhancing overall competitiveness.

This operational management reform is proposed in light of the reality of declining business conditions and continuous profit decreases in 2022, 2023, and 2024, based on the strategy of "controlling investment, expanding income, reducing costs, and increasing profits" that was put forward at the beginning of 2022 by Risun and strictly implemented continuously. The purpose of the operational management reform is to enhance profitability, return on investment, operational management efficiency, operational capabilities, management capabilities, and overall competitiveness. The goal is to fully implement the annual operational production plan and financial budget objectives, ensuring the achievement of specific targets of "controlling investment, expanding income, reducing costs, and increasing profits."

This operational management reform is based on the Group's recent revenue scale of RMB 50 billion and its nine production bases both domestically and internationally. It will once again create a closed loop in operational management at a larger scale and higher level, enhancing the competitiveness of the Risun system and laying the foundation for greater development space for the Group.

This management reform will be comprehensive, systematic, and thorough; it is not a short-term measure or a stopgap, but rather focuses on the fundamentals, the essentials, and the long term.

During different stages of its establishment, the Group faces various situations and formulates different strategies. These annual or multi-year operational management strategies together constitute the long-term core competitiveness of Risun. These specific strategies are also components of the Group's long-term strategy, collectively driving Risun to continuously progress and advance.

In 2025, Risun will continue to implement the annual business policy of "controlling investment, expanding revenue, reducing costs, and increasing profits" to ensure stable growth in volume and profit. Multiple measures will be taken to enhance efficiency, accelerate asset and capital management, continuously optimise the capital structure, reduce the scale and cost of liabilities, strictly control fixed asset investment, vigorously recover various debts, and rigorously reduce various costs on a month-on-month basis. At the bottom of the cycle, we will further forge the sustainable development capability of Risun, continuously enhance the profitability of each product line and business unit, and ensure the achievement of annual profit targets. Since its establishment, Risun has implemented five "Five-Year Development Plans". This year, we not only aim to fully complete the sixth "Five-Year Development Plan (2021-2025)", but also to comprehensively summarise and systematically review it. Based on this, and in light of our assessment of the domestic and international economic situation, we will formulate the seventh "Five-Year Development Plan (2026-2030)" (corresponding to the national "14th Five-Year" development plan), and based on Risun long-term vision for the next thirty years, develop a new ten-year development outline.

Today marks the thirtieth anniversary of Risun, reminiscent of my decision to start a business thirty years ago. The future of Risun will surely reflect the vibrant youth of those years, full of vigour and vitality, traversing the five continents and four seas, writing a new glorious epic, and making new and greater contributions to Chinese-style modernization.

Standing in 1995, although strong, energetic, and full of ambition with lofty ideals, one could never imagine what 2025 would be like thirty years later. Similarly, although Risun is very strong in setting its own development goals and plans, it is still impossible to imagine what Risun will look like in the next thirty years, or what we can shape Risun into over the next thirty years.

In the past thirty years, both the international environment and China's environment have been very favourable, especially in the thirty years prior to the reform and opening up, which greatly benefited the establishment, growth, and expansion of entrepreneurial companies; however, in the next thirty years, the international environment will be unpredictable and turbulent, while China's economic transformation will be filled with challenges, and entrepreneurial companies will face significant risks and crises. However, Risun now possesses not only the spirit of hard work as in the previous thirty years but also more methods, strategies, and means. Currently, Risun has both certain strength and more experiences and lessons to draw upon.

In terms of Risun itself, the first thirty years had more "uncertainty" than "certainty," while the external environment had more "certainty" than "uncertainty"; in contrast, the next thirty years will have more "uncertainty" than "certainty" in the external environment, while Risun itself will have more "certainty" than "uncertainty." These are all analyses of pros and cons, rather than decisive factors. What is decisive is that Risun still maintains a strong entrepreneurial passion and fighting spirit, which is our primary driving force towards the future.

With the historical achievements and growth genes of the first thirty years, looking forward from 2025 to 2055, the struggle process of Risun in the next thirty years may not be too clear or precise, but the general direction and outline can be described.

Continue to consolidate and enhance the global leading position of coke and coking chemicals and refined chemicals industries, increasing the width and depth of the moat, and any industries that have not reached the global first position must hurry to catch up.

Accelerate the development of the new energy industry, adhere to the twenty-seven character guideline for new energy development, layout different new energy industries simultaneously, and create Risun third pillar business segment in the shortest time.

Continue to expand the scale of metallurgical coal and washed coking coal, forming complementary advantages in the industrial chain, enhancing the competitiveness of the industrial chain, while also exploring other minerals, oil, gas, and other resources, strengthening and enlarging the resource industry to support the development of the manufacturing sector.

Continue to expand the new materials and refined chemicalsrefined chemicals field and scale, making it a new pillar business segmentRisun for Risunpillar business segment. To have a long-term vision, unaffected by temporary changes, and to resolutely implement the Group's strategy of "to achieve world-class leadership in any industry we enter," strengthening and expanding new materials and refined chemicals.

Proactively layout new industries such as synthetic biology, molecular refined chemicals, and functional refined chemicals, taking small steps quickly, with multiple projects, multiple research and development efforts, and layouts across various regions. After achieving small-scale success, we will expand rapidly to prepare the Group for tiered development, overcoming cycles, and traversing different eras.

Introducing technology, self-investment, and R&D innovation walk on three legs of self-development and mergers and acquisitions. Each industry has its own key factors and elements for growth and success. It is essential to grasp the essential logic of industrial development, to develop quickly and to layout rapidly. One must win the competition and seize the era, without being eliminated by the times while winning the competition.

Any industrial layout is determined by the competitive advantages of the global industrial chain and supply chain. In-depth research into the essential logic of competition and profitability within the industrial chain and supply chain is necessary to form global industrial competitive advantages.

The R&D and innovation in the technology industry encompasses all sectors, products, and services of the Group, especially the new industries, new products, and new services developed by the Group, which must lead the way in R&D and innovation.

The Group needs to increase its investment efforts based on the existing research and development innovation, strengthen its merger and acquisition activities, enhance global investment and acquisition efforts, and intensify the work on research and development innovation at each production base, continuously providing momentum for the Group's development. Dare to make appropriate proactive arrangements, engage in forward-looking mergers and acquisitions in technology research and development, and be adept at making suitable proactive arrangements and forward-looking mergers and acquisitions in technology research and development.

Transform the Group's governance system, institutional mechanisms, decision-making mechanisms, operational mechanisms, and management models to better support research and development innovation.

Continuously strengthen the introduction of various talents, persistently reform the incentive mechanism for research and development innovation work, and establish a system and mechanism for self-driven, self-motivated, and rapid development.

Based on the characteristics of industrial development and the distribution of talent, we are laying out technological research and development innovation across the country and globally.

The development of Risun ultimately relies on technological research and innovation, as well as innovation in business models and institutional mechanisms, which is the ultimate pursuit of Risun.

Rapidly establish a working situation for the rolling development of technology product research and innovation in a "three-step" approach of application development, mergers and acquisitions, and R&D reserves, thereby gradually increasing the contribution rate of R&D innovation year by year, enhancing the profitability of the Risun industry year by year, and gradually widening and deepening the Risun industry moat.

The R&D innovation of technological products not only serves the development of the Group, providing power and support, but also aims to become an independent, self-developing and self-circulating R&D cluster and industrial cluster, widely applying digital technology and artificial intelligence technology to enhance work efficiency.

The establishment of industrial bases and service bases is based on the inherent competitive advantages of different industries globally and the essential efficiency of global supply chains, while also laying out regional management centres, data centres, and research and innovation centres.

Economic globalisation is the essence, while de-globalisation is a false proposition. We must layout according to the characteristics of different countries in the international arena, while also considering the realities of conflicts and contradictions between various countries and regions to avoid risks.

Based on the resource industries and service characteristics of different regions such as ASEAN, the Middle East, India-Pakistan, North Africa, South Africa, South America, North America, Europe, Japan and South Korea, and West Asia, some areas are still in the early stages of industrialization, some have reached the mid-stage of industrialization, and some have begun modernization. We need to develop different industries, services, and research layouts according to the characteristics and development stages of different countries, as well as market demand and customer characteristics.

Every country and region must undergo the development from industrialization and urbanisation to modernization, which is a law proven by the history of human development in modern times. We need to enhance our understanding of this law in order to better plan the development of Risun.

Accelerate the national layout and global expansion of Risun business, simultaneously develop both domestic and international markets, increase overseas investment, expand the total number of overseas employees, and gradually increase the proportion of overseas assets, revenue, and profits. Gradually build Risun into a multinational company.

Innovative governance models, institutional mechanisms, operational mechanisms, and business management models must be continuously adjusted based on the characteristics of different countries and regions, as well as the specific traits of various industries, services, and research and development. Development should guide transformation, rather than being constrained by fixed models.

With thirty years of complete and accurate data accumulation, when we summarise the thirty years of Risun, we also place Risun into a larger macro-historical context for research. Through this iterative deduction, we can roughly project the core data related to cash flow, revenue, investment, liabilities, financing, and other aspects of entrepreneurial companies for the next thirty years. Although precision is impossible, we can derive several scenarios and generally imagine what level and extent Risun can reach in the next thirty years.

The Group's investment development must adhere to the "Seven Balances," namely: achieving a balance in the development of existing industries (specifically, balancing coke and coking chemicals, refined chemicals, new energy, and new materials); achieving a balance between investments in existing industries and new industries; achieving a balance in the allocation of light and heavy assets; achieving a balance between market-driven, investment-driven, and innovation-driven development; achieving a balance between internal investments and external mergers and acquisitions; achieving a balance in the coordinated development of manufacturing and service industries; and achieving a balance in the national layout and global expansion of the Risun business. Form a pattern of tiered development and sustainable development.

The Group will place greater emphasis on the contribution of R&D innovation investments to its development in the future.

The Group will place greater emphasis on the support of human capital investment for its future development.

The Group will focus more on investments in technology-intensive, proprietary technologies, and patented technologies in the future, rather than simply relying on cost and efficiency competition, to strengthen the continuous high-profit moat of Risun.

Innovate development methods, innovate growth approaches, improve development quality, and prioritise benefits.

The key to operating products and services lies in quality, price, cost-effectiveness, and efficiency, forming a community of shared interests with upstream and downstream customers.

Asset management refers to the continuous arrangement and combination of the Group's numerous assets based on the principle of achieving the highest return rate, enabling the Group to maintain high profitability while consistently navigating through cycles.

Capital management refers to the Group's strategy of managing different industries through equity operations, planning their entry and exit during different cycles, and laying out the Group's industries and capital over a larger space and longer period, leveraging the capital market and financial market to develop the industries and services of Risun.

The three types of operations aim for the sustainable operation and long-term development of Risun, which can effectively prevent the Group from being limited to a specific product and service, confined to a particular industry, restricted to a certain region, or bound to a specific era.

The three types of operations require different cognitions, talents, and capabilities. We need to expand our understanding, increase our talent pool, and enhance our capabilities according to the essential requirements of the three types of operations.

The three types of operations are based on the cash flow of products and services, seizing the trends and rhythms of asset value fluctuations, and understanding the trends and patterns of capital and equity market value changes, with the fundamental goal of achieving long-term sustainable development for Risun, thereby forming a multi-layered path and strategy for development and transactions. Three different types of operations require different transaction structures, methods, and strategies. The key factors for their success and competition vary, so the Group needs to gradually establish three distinct management methods and systems for these operations.

Investment, products, and services are global in nature, expanding their markets and investments worldwide; human capital is also global; with a large market capitalization, significant scale, and high profitability.

Culture, worldview, values, and corporate philosophy are universally applicable and can be accepted by the majority of countries and employees around the world. There are no overly specific or unique cultural or value pursuits. The focus is on business, industry, products, services, technology, and corporate advancement, adhering to laws and regulations, being compliant and legal, with a people-oriented approach and a creator-centred philosophy.

The development model, business model, products, and service business model are unique, sustainable, and continuously innovating, exhibiting a certain level of monopoly that is not easily imitated.

The governance model, decision-making model, institutional mechanisms, operational mechanisms, and business management model are advanced and ahead of their time, demonstrating strong competitiveness.

High investment in R&D, pursuing technological advancement, with strong digital and intelligent capabilities.

Simplicity, efficiency, and effectiveness, avoiding formalism and bureaucracy, decentralisation, flat and matrix structures, internet-oriented, focusing on the site, decisive action, and emphasising the frontline are distinct characteristics of operation management.

Characteristics of a democratic, equal, honest, fair, and transparent organisation.

Respect employees, respect facts, respect innovation, respect common sense.

Uphold corporate culture, adhere to worldview, values, and corporate perspective, maintain self-criticism and self-denial, uphold the understanding and judgement of the enterprise, and adhere to the theories and practises of the enterprise.

Due to the advancement of science and technology, the deepening of globalisation, and the high involvement of digitalization, intelligence, the Internet, the Internet of Things, and artificial intelligence, as well as the overlay of various technologies, the survival and development of enterprises will undergo significant and profound changes in the future.

The methods of products and services of enterprises will undergo continuous transformation.

The governance model, decision-making model, and institutional mechanisms of the enterprise will undergo continuous transformation.

The operational mechanisms, management models, supervision methods, and risk control approaches of the enterprise will undergo continuous transformation.

The organisational model, production model, service method, and talent model of the enterprise will undergo continuous transformation.

The technological advancement and R&D innovation models of enterprises will undergo continuous transformation.

The industrial chain model and supply chain methods of enterprises will undergo continuous transformation.

The enterprise's on-site, physical environments, factories, and storage and transportation will undergo continuous transformation.

The enterprise's production base development and project-based management model will undergo continuous transformation.

Regardless of the industry or sector, service-oriented and innovative approaches are the fundamental direction for the survival and development of enterprises in the future.

Always adhere to business model innovation, institutional mechanism innovation, and technological product innovation, with innovation leading the future, and always insist on entrepreneurship, creation, and innovation.

These changes are intertwined, much like the industrialization, urbanisation, and modernization processes of human society over the past two hundred years, with significant transformations occurring every five to ten years. In the future, due to the cumulative effects of various scientific and technological advancements, changes will occur even more rapidly. We must actively adapt, strive for progress, catch up, and never be eliminated by the times.

Risun has grown into a regionally renowned company over thirty years, with its business expanding nationwide and globally. In the next thirty years, we must strive to become a nationally and globally renowned industry and service group.

While strengthening regional presence, we actively expand nationwide, striving to become a well-known enterprise across the country within ten years.

While establishing a nationwide layout, gradually expand globally and become a globally renowned multinational company in thirty years.

Gradually transform Risun into an innovative manufacturing industry and a service-oriented manufacturing industry.

In the face of the different stages and characteristics of development in various countries and regions, we must not only maintain the development methods and management approaches of the first three industrial revolutions and scientific and technological revolutions, but also innovate our development methods and management approaches in accordance with the characteristics of the fourth industrial revolution and scientific and technological revolution, ensuring that we always stay at the forefront of the times.

Risun currently has a certain scale and contribution, but it is negligible and insignificant for the Chinese economy, and can be said to be dispensable. In the next thirty years, we must build Risun into an indispensable presence in the Chinese economy and the global economy, with specific indicators including:

Either science and technology are indispensable.

Either the global industrial chain or the supply chain is indispensable.

Either the products and services are indispensable;

Either employment contributions or tax contributions are indispensable.

Only in this way can there be essential competitiveness and a foundation for long-term development; it is precisely for this reason that long-term development is possible and that one can possess a moat that others cannot surpass.

Thirty years ago, Risun chose to start a business with lofty ideals, firm beliefs, and strong willpower, but did not know exactly what to do, to what extent, or how to do it, only filled with passion, determination, and a spirit that was not afraid of hardship or death.

It is precisely this spirit of selfless dedication, continuous effort, and hard work, in harmony with the tide of the times, that has enabled all the cadres and employees of Risun to create a new realm and achieve remarkable success.

In the tide of the times, Risun has seriously built its business for thirty years with its own courage and support from various parties, gaining a certain understanding of society, economy, market, industry, and company, and accumulating the logic and essential capabilities for long-term survival and development. Facing the future, due to the continuous expansion of boundaries and the gradual increase of uncertainty, we still know very little. In the past thirty years, both the world and China have undergone rapid changes and upheavals that were unimaginable to anyone, any company, or any country thirty years ago. Similarly, in the next thirty years, whether in the world or in China, there will be monumental changes and rapid developments; no matter how intelligent or wise a person is, it is impossible to make accurate predictions. This is society, this is history, this is China, this is the world.

The history of the past thirty years, the past hundred years, the past few hundred years, and the past thousand years has repeatedly proven that human history, the history of any country, is unpredictable; this is the most authentic existence of human history. Even with astonishing similarities, they are never identical; this is also the driving force behind generations of continuous struggle in human society. Talent emerges in every generation, each leading the way for decades; no generation can exhaust the future, and history cannot and will not come to an end.

Although the current Risun cannot predict the development of future society, nor can it accurately forecast the future of Risun, the history of the company's development over the past two hundred years tells us that only by investing in the future can success be achieved. In the past thirty years, the reason why Risun has achieved some success is due to a firm belief in the future and investment in the future. Therefore, since the current Risun possesses greater material and spiritual wealth than when it was founded thirty years ago, it must invest in the future more boldly, on a larger scale, with greater determination, and at a faster pace. This is the only path for Risun to achieve sustained success and greater success; there is no other way.

Many great companies in the world possess numerous outstanding qualities, among which the most important is the belief in the future and investment in the future. The development of the economy and society is driven by numerous great technological inventions, many outstanding companies, and many excellent products and services. Choice is greater than effort, and trends are greater than ability. We must bravely face the future and move towards it.

We must discard all illusions. No matter what happens, no matter what changes occur, no matter whether the situation is favourable or unfavourable, no matter whether the environment is good or bad, we must firmly believe in the future, believe in the times, believe in society, believe in the country, and believe in ourselves. We must believe that there is always a future, that the times are always progressing, that society is always developing, that the country is always improving, and that we will become stronger.

Past success does not guarantee future success, and past experiences may not necessarily apply to the future, as repeatedly demonstrated by countless outstanding enterprises. Risun can only put down the burdens, forget past achievements, discard mature experiences, break established traditions, reset everything to zero, clear everything, empty oneself, march lightly into battle, closely follow the times, closely follow society, closely follow the nation, stay grounded, be determined to strive, create a better tomorrow, and forge the next glorious thirty years.